Two Bitcoin whale wallets, which had been dormant for 13 years, have become active again as the BTC price pushes year-on-year highs. Bitcoins issued in 2010 have been moved to different wallets today.

Bitcoin whales move $3 million after 13 years of sleep

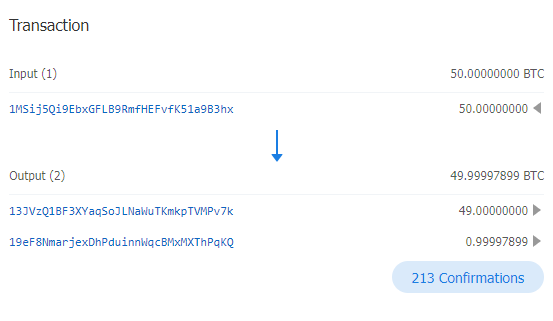

Data from explorer.btc.com shows that two whales recently moved a total of 100 BTC. Both whales transferred 50 BTC to anonymous wallets. Who was behind the transactions could not be determined until now. However, both whales represent the sixth and seventh early investors carrying BTC this year. The BTCs in question were issued in 2010 and have been dormant until now.

Transfers came amid the critical recovery of BTC price

BTC price fell to $ 24,800 in June due to developments such as SEC lawsuits and Fed interest rate decision. After the ETF developments that started with Blackrock, the current price had the opportunity to climb to $30,000. Recent whale transfers come amid the critical recovery of BTC price following renewed institutional investor interest. According to Coinecko, BTC is currently trading at $30,715.06, up 15% over the last 7 days.

Whales collect BTC at $ 0.1

The BTCs that took action today were obtained through mining in 2010. Its owners have chosen to remain “HODLers” despite all the market peaks for nearly 13 years. BTC price was trading below $0.1 during this period.

Developing tools for blockchain analysis, Dr. Kirill Kretov says that in 2010 Bitcoin mining was probably down to computer experts experimenting with the technology, but it’s hard to know if Bitcoin has hit the market since then.

Why are Bitcoin whales waking up now?

“There is this unique spirit of crypto anarchy and technology behind such legacy addresses,” Kretov said. It’s like a time machine. “Thousands of people are speculating as to why these Bitcoins are being transferred now.”

However, he says that these BTCs obtained by mining in 2010 belong to computer experts who tried the technology at that time. The reason why they prefer 2023 may be for sale purposes or change of wallet.

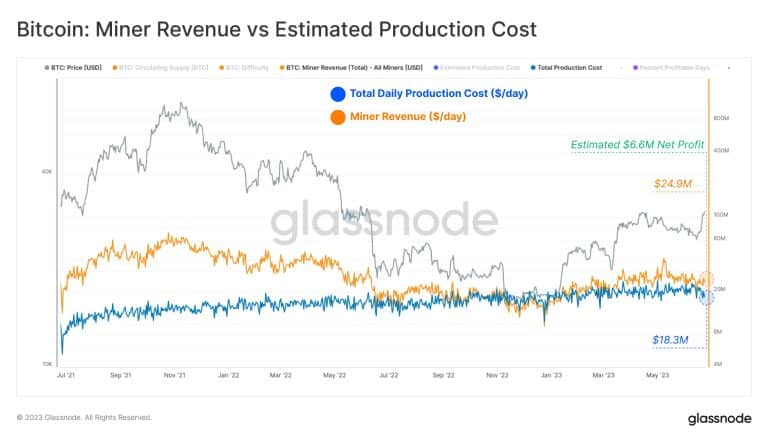

Miner revenue has decreased significantly, according to Glassnode

Notably, the total daily production cost was $18.3 million, while miner revenue reached $24.9 million. This resulted in an estimated net profit of $6.6 million. Declining miner income revealed the need for miners to optimize their strategies to adapt to changing market conditions.

cryptocoin.comIn April, we reported that a few whales from the Satoshi period woke up.