Bitcoin price has dropped by around 3.5% starting in the past hours. At the time of writing, it is trading in the $26,200 region. US Treasury Secretary Yellen’s statements also negatively affected traditional markets and gold and silver prices.

Janet Yellen’s statements caused a drop in Bitcoin and other markets

The US Treasury Secretary recently spoke at a panel organized by the Wall Street Journal. Yellen’s statement includes the following words:

There may not be enough cash at the beginning of June, we will soon inform Congress about the government’s finances and we will have some obligations that we cannot pay. It is possible that there is an agreement. We are seeing stress in the financial markets and a possible default could result in severe financial market distress.

I believe the debt limit will be lifted and there could be significant market woes before a possible default. It is difficult to say in advance when our resources will run out.

US Treasury Secretary Janet Yellen expressed her belief that the debt limit will be lifted. However, the blockage of debt limit talks is among the main developments that brought the BTC price down. President Biden and his team have been unable to reach an agreement with the other parties on its removal for days. This uncertainty brings short-term selling pressure to the markets.

Meanwhile, the next FOMC meeting will be held June 13-14. Currently, the market expectation is 25 basis points. On the other hand, CryptoQuant suggested in a recent report that BTC could drop to $20,000 by then.

NUPL index points to bear trend

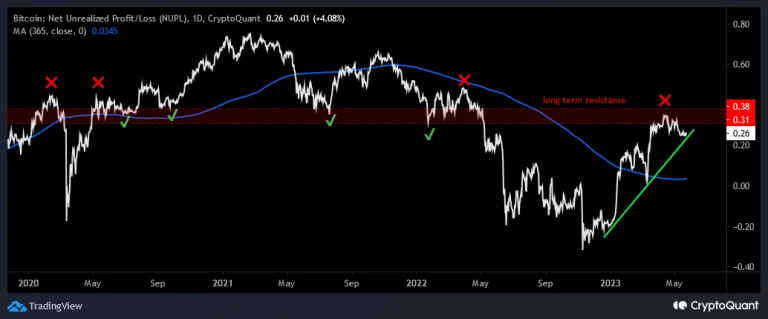

According to a recent report from CryptoQuant, Bitcoin faces certain risks, as demonstrated by the Net Unrealized Profit/Loss (NUPL) Index. The leading crypto has struggled to overcome the long-term resistance created by this index. This points to potential challenges ahead.

The NUPL index, which measures the profitability of Bitcoin investors relative to the purchase price, has created a bearish pattern known as the Head and Shoulders (H&S). This development raises concerns that Bitcoin could go bearish and potentially fall into the $24,000 to $20,000 range.

If the bearish H&S pattern plays out successfully, it will break the local uptrend observed in the NUPL index. This further adds to the uncertainty surrounding Bitcoin’s future performance. The crypto market is watching these developments closely as it can significantly impact investor sentiment and trading strategies.

However, there is a glimmer of hope for Bitcoin’s rise. The 365-Day MA represents a crucial long-term support level that has not yet been broken. If Bitcoin can sustainably overcome the long-term resistance it is currently facing, it will invalidate the scenario outlined above. Thus, the bulls can potentially restart the positive momentum.

Bitcoin price predictions

cryptocoin.com In this article, we have included the price predictions of analysts such as Mike McGlone and Rekt Capital. Until Janet Yellen’s statements, BTC was preparing to close the day on a positive note. With the recent decline, it has returned to the critical support zone at $26,200.