After Fed Chairman Jerome Powell announced that he would not change interest rates, the cryptocurrency market experienced a sharp correction led by Bitcoin (BTC). In the past 24 hours, the price of Bitcoin has dropped more than 3.5 percent, losing the critical support level of $25,000. Here are the details…

Bitcoin market is down

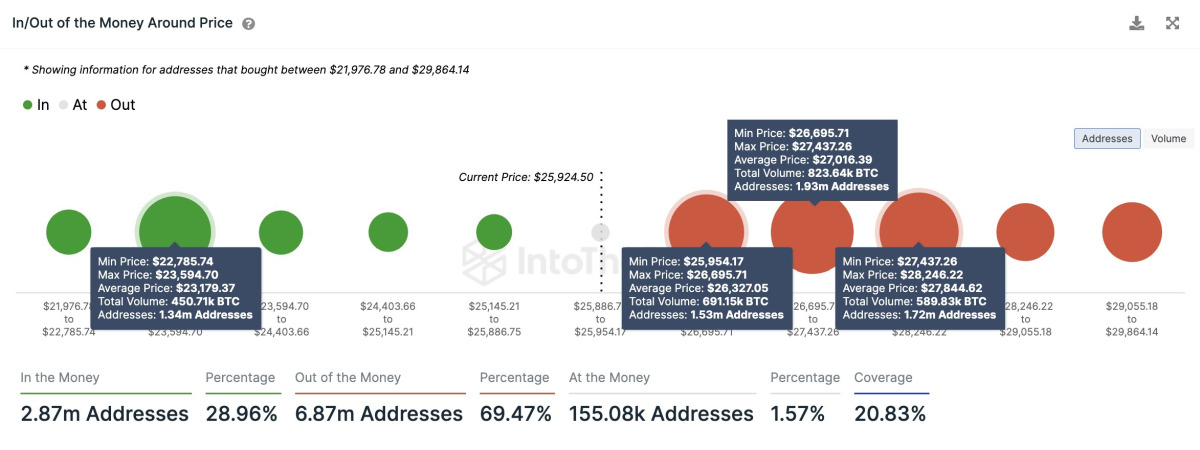

Simultaneously, the broader cryptocurrency market has witnessed a significant erosion of over $40 billion in investor wealth and is on the verge of falling below $1 trillion. Bitcoin is on thin ice with a key support zone between $22,785 and $23,595, according to popular crypto analyst Ali Martinez. Approximately 1.34 million wallets holding 450,000 BTC are located in this critical range. On the other hand, BTC is facing a tough resistance between $26,000 and $28,250. 5.18 million wallets bought 2.1 million BTC.

The year 2023 saw a divergence between Bitcoin and US stocks in terms of correlation. After Powell’s speech, US stocks followed a sideways course as the Fed Chairman hinted that two more rate hikes could be made this year. The bitcoin and crypto market has responded quickly to these developments, coupled with ongoing liquidity challenges due to SEC lawsuits against major crypto exchanges like Binance and Coinbase. Many banking partners have reassessed their relationships with these exchanges due to current regulatory uncertainties.

There we go on #Bitcoin.

The lows are getting swept.

Heavily interested to see response at the $25K region. pic.twitter.com/0ekuDdRptL

— Michaël van de Poppe (@CryptoMichNL) June 14, 2023

Bitcoin suffered a notable drop, while altcoins faced an even deeper correction. Ethereum (ETH), the world’s second-largest cryptocurrency, slumped over 5.5 percent and slumped below the $1,650 level. Other leading altcoins such as BNB, XRP, Cardano ADA and Polygon MATIC also corrected over 6 percent. The market seems to be under the control of the bears at the moment and it remains unclear how far this correction will extend.

Interest rate expectations rise

The reasons behind Bitcoin’s decline can be attributed to the upward revision of individual FOMC members’ expectations for future interest rates. An increase was seen in the dot chart showing the interest expectations of Fed members and the average interest rate expectation reached 5.6% at the end of 2023. As a result, it is assumed that two more rate hikes will be made in the remaining four meetings this year. Fed Chairman Jerome Powell said at the press conference, “It may be appropriate to make a few more rate hikes this year,” and emphasized that no decision has been taken for July.

Economists called the Fed’s decision and Powell’s words a “hawkish pause”. “People were expecting a hawk pause, but they got a very hawkish stop,” commented David Russell, senior manager at TradeStation. Russell also suggested that with a strong labor market, the Fed would not want to miss an opportunity to contain inflation.

Jeffrey Gundlach, CEO of DoubleLine Capital, also known as the “Bond King”, described the Fed’s decision as a “hawkish pause”. “The Fed was absolutely hawkish in rhetoric, but not in action,” Gundlach said. Moreover, he believes that the Fed will not continue to raise interest rates. Bitcoin, the highest cryptocurrency by market capitalization, dropped to $24,820 for the first time since March and fell below $25,000. In fact, at the time of this writing, Bitcoin is changing hands at $24,886. As the cryptocurrency market faces increasing regulatory oversight and liquidity issues, investors are eagerly awaiting developments that could shape the future trajectory of the market.