Bitcoin is expected to experience a big drop in September and it will not be easy for investors. We could suffer similar pains if history repeats itself, as data shows this month’s regular red closes. So why is September so ominous and what has happened in the cryptocurrency market before?

Cryptocurrency investors move forward in “sinister” September

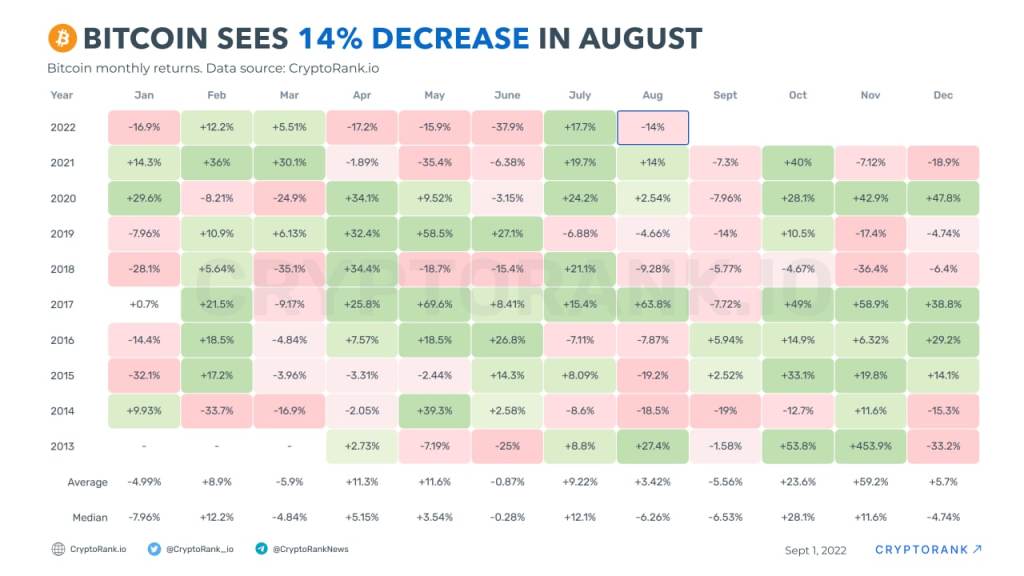

September has historically hurt crypto investors. According to Cryptorank data, the first month of autumn has brought huge losses for Bitcoin over the past five years. Throughout its history, Bitcoin has only seen a positive September in 2016 and 2015. This month results in an average loss of 5.56% for Bitcoin. Considering that it can drop 20% in just 4 hours, this decrease may seem insignificant.

September losses usually occur before or during bull runs. For example, the biggest depreciation was the 19% drop in 2014. BTC closed September in green for the next two months. Meanwhile, it suffered its second biggest loss in September 2019, when it was trading around $9,000. Based on the current state of the market, there is a possibility that Bitcoin is heading in the same direction as it has been for the past few years. But according to many analysts, the market impasse is an ideal opportunity to stockpile cryptos like Bitcoin and Ethereum.

In the overall picture, long consolidation could eventually trigger further declines. This will result in a slight loss for Bitcoin investors and a repeat of last year’s results. Fortunately, the month after September paints a more positive picture, with notable gains in six of the nine-year history of Bitcoin.

What could go wrong?

The only notable event in September is the highly anticipated Ethereum merge update that will cause occasional market volatility if it experiences technical difficulties delaying the upgrade. Fortunately, potential issues are more likely to affect Ethereum than Bitcoin. To sum it up, Ethereum’s historic transition to PoS will happen this month. If all goes well, Ethereum will become an altcoin that no longer needs mining. Therefore, a more energy efficient Ethereum means it will get more support from regulators.

Why is Merge so important to Ethereum (ETH) and the Web3 space as a whole? Let’s list a few items for this:

- Merge will replace the PoW consensus with PoS, where Ethereum (ETH) network integrity will be secured by stake investors rather than miners.

- A first in crypto history where a mainstream protocol has radically changed the consensus design.

- Ethereum Merge is already active on the Hive and Sepolia testnet. Goerli activation will be dress rehearsal before mainnet.

- Proof-of-stake (PoS) consumes less energy. It also reduces the carbon footprint of a network and makes it more decentralized; Once the Ethereum (ETH) proof-of-stake becomes available, the next step will be to switch to sharding.