The crypto community on Twitter has been talking about the future of Binance Coin (BNB) lately. Generally, concerns and speculations are about whether BNB will be like the FTT of the bankrupt exchange FTX. So, is there any justification for the concerns?

Changpeng Zhao draws attention in the cryptocurrency market

The cryptocurrency market is in a long-term bear market. The collapse of more projects, exchanges and platforms only deepens the potential bottom. The collapse of Terra LUNA in May 2022 and the bankruptcy of FTX in November brought Bitcoin (BTC) and the cryptocurrency market to lows that no one expected. In this devastated battlefield, one figure and his project seem unaffected: Changpeng Zhao (CZ) and Binance Coin. CZ is positioning itself as a legitimate defender of the cryptocurrency industry by establishing the SAFU cryptocurrency fund among a number of startups.

On the other hand, CZ is increasingly on the agenda with the founders of other exchanges in verbal attacks, deleting tweets attacking competitors and transferring large numbers of tokens between wallets. Suffice it to mention that there was a direct conflict between SBF and CZ before the collapse of FTX. In this context, the price movement of the exchange’s native token Binance Coin (BNB) since 2021 is as impressive as it is thought-provoking. The crypto community on Twitter recently highlighted a few anomalies around the Binance ecosystem and BNB price action.

Binance Coin (BNB) rise is unnatural?

Binance Coin is currently the 4th largest cryptocurrency after BTC, ETH and USDT with a market cap of $46.3 billion according to CoinMarketCap. When we look at the Binance Coin price action since the beginning of 2021, we see a huge increase from January to May 2021. cryptocoin.comAs we have also reported, in last year’s bull market, BNB increased by about 2,100% from $32 to an all-time high (ATH) of $704.6.

Interestingly, six months later, in November 2021, the BNB price failed to break the record high. It peaked at $696.1. Binance Coin price started a bear market after forming a long-term double top pattern. The current low was reached mid-June 2022 at $183.4. This is equivalent to a 73.5% drop from the November peak. It’s been about six months of consolidation since June’s low, and Binance Coin is trading in the $290 region today.

Thus, we can see that the price action of BNB/USDT follows a pattern we recognize in the broad cryptocurrency market: exponential increases during the bull market and drastic decreases during the bear market. What sets Binance Coin apart from other altcoins is the depth of the dips. Indeed, the 70% drop since its ATH turned out to be considerably less than the drop of all major cryptos. For example, ETH has dropped 82% since its ATH, DOGE 93%, ADA 90%.

BNB made ATH on Bitcoin pair

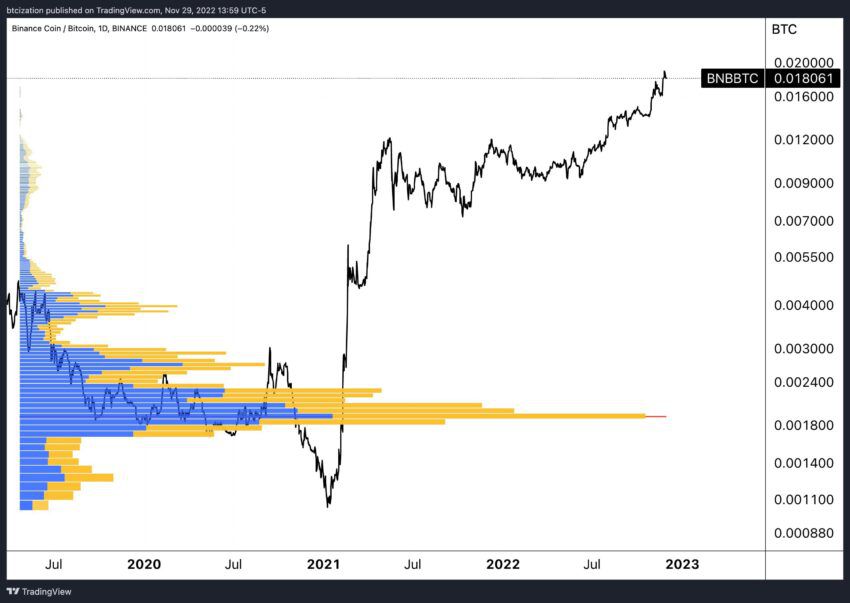

The price of BNB has regularly reached ATH against the price of BTC since mid-2022. If there were any declines, they did not exceed 45 percent. On the other hand, the increase in the value of BNB relative to BTC is impressive. First, since the start of 2021, the price of BNB has skyrocketed from 0.00100 BTC to 0.01235 BTC, recording a 1.075 percent gain in the largest cryptocurrency pair.

It then experienced a correction that ended shortly before the start of a broad crypto bear market. When Bitcoin reached its ATH in November 2021, the price of BNB was 0.00911 BTC. But just one year later, in November 2022, Binance Coin registered an all-time high of 0.01970 BTC. Binance Coin rose 117 percent against BTC during a year-long bear market.

Will Binance Coin (BNB) end up like FTT?

These impressive earnings of Binance Coin recently caught the attention of cryptocurrency market analyst @DylanLeClair_. He published a series of tweets in which he pondered the reasons for this performance of Binance Coin. The analyst compared the 2020-2021 BNB and FTT charts, both of which show a period of about a year. Then there was an exponential price boom in early 2021. The analyst shared the following GIF in response to arguments claiming that the price increase in BNB was due to the breadth of usage of the token. He pointed out that the same was true for FTT at the time.

I'm sure it was retail that sent BNB 10x in two months. Same with FTT, right?

It definitely wasn't the exchange operator with an incentive to drive up the price of their own token to create a feedback loop of attention, hype, and more users…

Definitely not. pic.twitter.com/j2Z49SEuLA

— Dylan LeClair 🟠 (@DylanLeClair_) November 29, 2022

The analyst states that indeed, in last year’s bull market, many altcoins outperformed Bitcoin. Among the biggest “winners” of that era, he lists: “SOL (Alameda leverage and fraud), AVAX (3AC), LUNA.” It concluded that all such actions are “modern enterprise” and the creation of empty tokens. “The recipe is simple: create a roken, use it in an illiquid market, and decorate everything with stylish expression,” he added.

Binance Coin price: Spot and futures

In response to this thread on Twitter, @MatthewHyland_ drew attention to his trading activity. Indeed, BNB Smart Chain’s chart of trading activity has been falling steadily since November 2021. There was an 80 percent drop since last year’s peaks.

Dylan check the BNB transaction activity

Down 80% pic.twitter.com/7YKW78eVCn

— Matthew Hyland (@MatthewHyland_) November 29, 2022

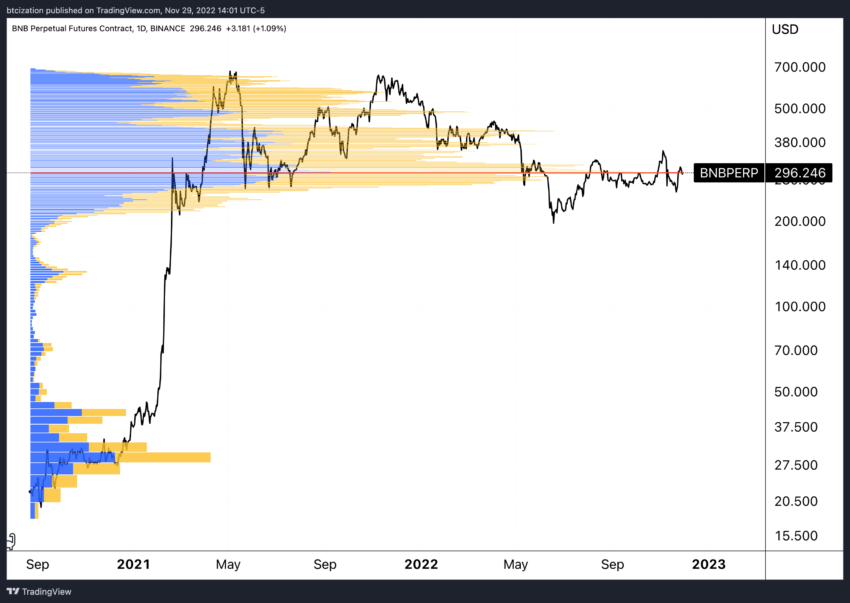

But Dylan LeClair has put two charts of BNB price side by side with prominent VPVR (Volume Profile Visible Range) levels. This indicator compares price levels with trading volumes. In the BNB/BTC spot market, the chart has major support levels close to 2020 prices before the exponential breakout.

However, when looking at perpetual futures contracts for BNB, the situation is the opposite. Leveraged traders created large volume in the high price areas reached from mid-2021 to date. According to the analyst, this is proof that the BNB/USDT pair is heavily over-leveraged. It can signal that there will be a problem in the future.