After the Grayscale victory of August 29, Bloomberg analysts increased the rate of approval of Bitcoin ETFs. The Grayscale lawsuit decision was a positive step for the US’s first spot Bitcoin ETF. Bloomberg analysts also put the odds of approval of ETFs as high as 75%.

Analysts say we’ll likely see a Bitcoin ETF approval

Bloomberg analysts Eric Balchunas and James Seyffart announced that the chances of getting approval for a spot Bitcoin ETF in the US have increased following the Grayscale victory. This significant development comes after the US Court passed a motion to convert Grayscale’s Bitcoin Trust (GBTC) to a spot BTC ETF.

Previously, Balchunas held spot ETF approval around 65%. This shows that the probability of approval is higher than rejection. According to his new update from account X, analysts are now raising the probability of confirmation to 75%.

NEW: @JSeyff & I are upping our odds to 75% of spot bitcoin ETFs launching this yr (95% by end of '24). While we factored Grayscale win into our prev 65% odds, the unanimity & decisiveness of ruling was beyond expectations and leaves SEC w "very little wiggle room" via @NYCStein pic.twitter.com/IyEGmWjuHa

— Eric Balchunas (@EricBalchunas) August 30, 2023

Bloomberg analyst Eric Balchunas wrote on account X today about the increased rate in question:

James Seyffart and I increase our chances of spot Bitcoin ETFs to be released this year to 75% (95% at the end of 24). While we factored the Grayscale win into our previous 65%, the resolution’s unanimity and determination was beyond expectations, leaving “little room for action” to the SEC.

Grayscale leads market for Bitcoin ETF approval

Meanwhile, leading financial institutions like BlackRock and Fidelity are competing to get the first ever spot Bitcoin ETF from the federal regulator. After Grayscale’s victory in court, the crypto community shares a general optimism that ETF approval will have a higher probability in the near future.

How BTC whales celebrated Grayscale’s victory

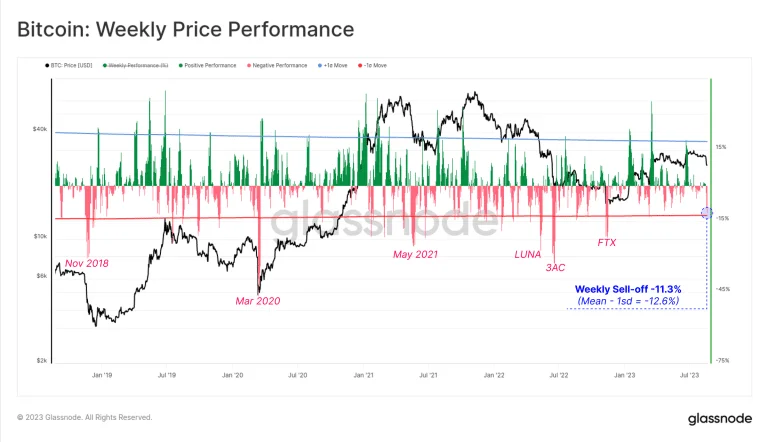

On August 17, unexpected violent selling in the Bitcoin market plunged BTC below $25,000 for the first time since June 20. This leverage reduction event ended with the removal of $2.5 billion worth of open interest from the futures markets within a few hours.

As sentiment weakened, BTC’s price remained at $26,000 in the days that followed. On the daily chart, key momentum indicators fell to their lowest levels in two years. This marks a significant drop in Bitcoin accumulation.

However, during the intraday trading session on August 29, the BTC price climbed above $27,000. Thus, it is back to the price point before August 17th. This increase in price was a result of increased network activity after Grayscale’s victory over the SEC.

BREAKING: There it is, @Grayscale wins their lawsuit against the SEC. DC Circuit court of appeals is vacating SEC's denial of $GBTC's conversion into an ETF. pic.twitter.com/gqFvMpmfnm

— James Seyffart (@JSeyff) August 29, 2023

Bitcoin investors were the biggest winners

After the news of the court’s decision was heard, the social activity of BTC increased. According to Santiment, the social volume of the coin instantly increased by 7% as the controversy around Bitcoin escalated.

📊 After the news of #Grayscale's victory over the #SEC quickly lifted #crypto markets, the biggest notable beneficiary actually has turned out to be #BitcoinCash, due to its increased exposure. This phenomenon was similar to what we saw in mid-June when the #ETF news was first pic.twitter.com/HzEEEqZqIt

— Santiment (@santimentfeed) August 29, 2023

cryptocoin.com In this article, we have included the first reaction of the Bitcoin market after the Grayscale victory. The leading crypto is currently maintaining its gains in the $27,200 region.