Bitcoin price witnessed a massive 5% drop after Fed Chairman Jerome Powell’s statements. With the recent decline, it is heading towards the CME gap, which is suggesting a 20% loss.

Will Bitcoin price fill the CME gap that has suggested a 20% drop?

The crypto market has been in turmoil since the Binance and Coinbase lawsuits of the week of June 5. The second crisis was triggered by the Fed’s decision to keep interest rates constant. Bitcoin lost $25,000 last night after Powell’s statements. The downward momentum continues with a 5% decline that engulfs the market today.

In the current situation, there are concerns about whether Bitcoin will continue to drop to fill the $20,000 CME gap. A huge gap was formed between $20,260 and $21,340 during mid-March trading, just before the leading crypto advanced to the year-high $31,200. This is currently the only unfilled CME gap that could be filled in the coming days. If it does, the Bitcoin price will see a 20% loss from its current levels.

Crypto market trades sideways after Fed signals falconry

The market movements of June 15 strengthen the possibility of BTC filling the CME gap. Data from TradingView shows that Bitcoin was trading at $26,000 within $200 on either side of the support for most of the day, but was hit by a sell-off that dropped it to a daily low of $24,925 in the afternoon. Right now the bears are pushing to extend the losses further.

According to Jim Wyckoff, senior technical analyst at Kitco, the lack of early action for BTC reflected the futures market as “July Bitcoin futures prices were almost flat in quieter US trading on Wednesday.”

“BTC bears have the short-term overall technical advantage as there is still a slight price bearish bias on the daily bar chart,” Wyckoff said. “The path of least resistance for prices is currently falling sideways.”

Bitcoin price quickly lost the critical $26,400

Prior to the FOMC announcement, crypto analyst Michaël van de Poppe said that $26,400 would be a crucial resistance level for Bitcoin. He stated that this level will likely result in a pullback to the $24,500 – $25,000 region. Poppe’s predictions came true in part with the price movements of the day.

Discussed in the YouTube update today, but $26.4K crucial resistance for #Bitcoin and couldn't break.

Expecting the markets to drop into FOMC and to take the lows, ultimately area around $24.5-25K is a great area for longing.

And then, we'll have to see what happens. pic.twitter.com/XgoHK0g9OW

— Michaël van de Poppe (@CryptoMichNL) June 13, 2023

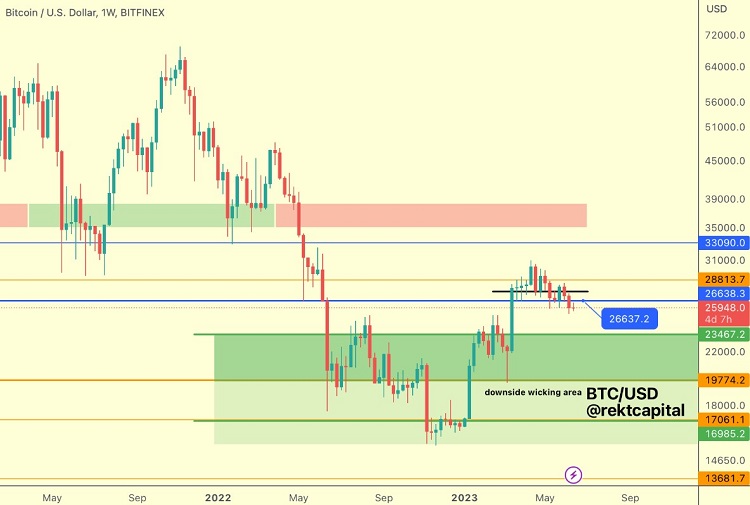

Market analyst Rekt Capital posted the chart below, which says, “The bearish trend continues for BTC as the price has made another Weekly Close below a key Weekly level.”

Rekt Capital stated, “Blue ~$26600 support is lost. If BTC relief rises from here, it will soon turn into resistance. “After the rejection at $26,600, $20,000 awaits us,” he says. Bitcoin is currently consolidating just under $25,000. cryptocoin.comAs we have reported, miner sales were also behind the downward momentum.