The US SEC has taken legal action against leading cryptocurrency exchanges Coinbase and Binance. Thus, while the SEC strengthens its control, the cryptocurrency industry is swimming in turbulent waters. But despite regulatory hurdles and liquidity concerns, Bitcoin shows remarkable resilience. Market expert Abhay H assesses the market and explains what’s on the horizon.

What’s in the macro scene?

Investors are currently factoring in a pause. But unexpected rate hikes by the Reserve Bank of Australia and the Bank of Canada prompted speculation that the Federal Reserve could similarly surprise the market on Wednesday. The result largely depends on the Consumer Price Index (CPI), released on Tuesday.

#CryptoNews: The Commonwealth Bank of Australia (CBA) has announced that it will limit payments to some #cryptocurrency exchanges that are considered high-risk by the bank. 🤓https://t.co/F3wN6lscF3

— CoinMarketCap (@CoinMarketCap) June 9, 2023

The Fed is likely to choose a pause as the CPI came in below expectations. This is because the Treasury is gradually replenishing its account with the Federal Reserve. In addition, it gradually withdraws liquidity from the markets. Moreover, the Bank of Japan considered selling stocks, adding to the potential market impact.

Cryptocurrency market collapse concerns

Speaking of stocks, US politician Nancy Pelosi and her husband allegedly sold a million dollars worth of Apple stock. It looks like Pelosi has donated though. It is worth noting that Nancy Pelosi is famous for her claims of ‘inside trading’. So much so that Pelosi has multiple Twitter profiles dedicated to tracking her trade. The fact that this latest sale comes after Apple shares hit an all-time high provides important context for the transaction.

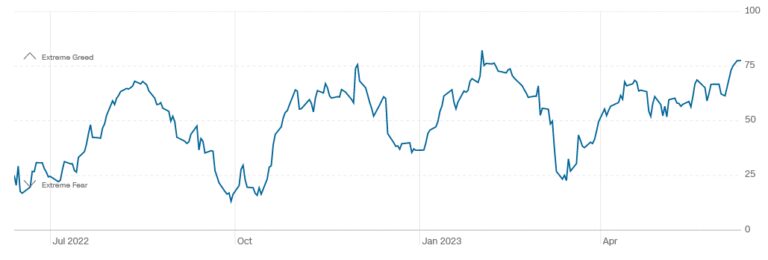

Source: Fear and Greed Index – Investor Sentiment

Source: Fear and Greed Index – Investor SentimentThere is growing concern that the markets are heading towards a crash. Also, various indicators reinforce this feeling. The stock fear and greed index recently reached its highest level in recent years. Thus, it showed that the level of fear and greed of investors increased. Despite the already low sentiment values, this means potential downside risk for cryptocurrencies. After all, extreme greed in the markets often precedes a market crash.

The ‘Black Swan’ event for Ethereum is approaching

Meanwhile, one of the co-founders of Ethereum is allegedly selling more than 10% of its ETH holdings. Interestingly, cryptocoin.com As you follow, the Ethereum Foundation has also recently sold ETH. Such operations are normally insignificant. With that came a potential black swan event for Ethereum. The long-awaited Hinman documents have been announced. These documents have the potential to reveal alarming information about Ethereum and its relationship with the US SEC.

The changing landscape of US cryptocurrency exchanges

At the same time, a noticeable shift is taking place among US-based exchanges offering cryptocurrencies to individual investors due to the recent regulatory action taken by the SEC against Coinbase and Binance. This has led CEXs to reassess the coins and tokens they are making available. Many exchanges have delisted Filecoin’s token FIL due to regulatory reviews in recent weeks. The worrying thing is that these exchanges have started delisting DeFi tokens as well. This may be because the SEC’s continued efforts to create regulations that allow them to take action against DeFi protocols.

The full list of tokens deamed securities by the SEC. Over 50 in total.

NEAR, matic, sol, icp, fil, luna (lol), bnb, ada pic.twitter.com/2itcPTHYj0

— Tom Dunleavy (@dunleavy89) June 11, 2023

It is worth noting, however, that truly decentralized protocols remain beyond their reach. Unfortunately, the anti-crypto sentiment witnessed in the US has also spread to other parts of the world. The crackdown on crypto in the US has reportedly sparked new debates in the EU regarding the classification of coins and tokens. Also, a leading Australian bank has decided to stop processing certain payments to crypto exchanges.

There are positive developments on the horizon.

However, we may soon witness a positive development from the Middle East, a “white swan” so to speak. Saudi Arabia’s sovereign wealth fund diversified its investments to support oil revenue. Given that the kingdom’s central bank is currently investigating crypto regulation, there is a possibility that Saudi Arabia may turn to cryptocurrencies as part of its diversification strategy. There are exciting times ahead!

Regulatory scene for cryptocurrency

The crypto industry in the US is facing a significant attack as unprecedented hostility emerges between regulators and the tech industry. This week, the US Securities and Exchange Commission (SEC) filed lawsuits against Coinbase and Binance, targeting several prominent project tokens such as SOL, ADA, and MATIC, classifying them as unregistered securities.

The announcement resulted in users withdrawing nearly $4 billion from the affected exchanges. The SEC accused both exchanges of trading unregistered securities, escalating claims against CZ’s empire, alleging that funds were mixed and self-traded. Accompanying the lawsuits, SEC Chairman Gary Gensler made harsh statements questioning the core functionality of cryptocurrencies during a CNBC interview shortly after announcing the regulatory actions.

Following the SEC’s lawsuits against exchanges, other platforms not named in the lawsuits also moved quickly to avoid similar regulatory repercussions. Robinhood, for example, announced Friday that it will no longer support Cardano, Polygon, and Solana tokens, which have been flagged as unregistered securities in lawsuits by the SEC. Robinhood users holding these tokens in their exchange accounts will have until June 27 to withdraw or sell these assets before they are automatically sold at market price.

Earlier this week, the SEC sued crypto companies Binance and Coinbase. The SEC has alleged that a number of cryptocurrencies trading on those platforms are unregistered securities, including three that are currently supported on Robinhood Crypto. (1/4)

— Robinhood (@RobinhoodApp) June 9, 2023

The announcement by Robinhood dealt a significant blow to the prices of the affected tokens, which were already affected by the SEC’s classifications. The aggressive actions of these platforms show deep concern in the cryptocurrency industry that regulatory pressure from the SEC could expand to include other market participants.

Parallels between FTX and Binance

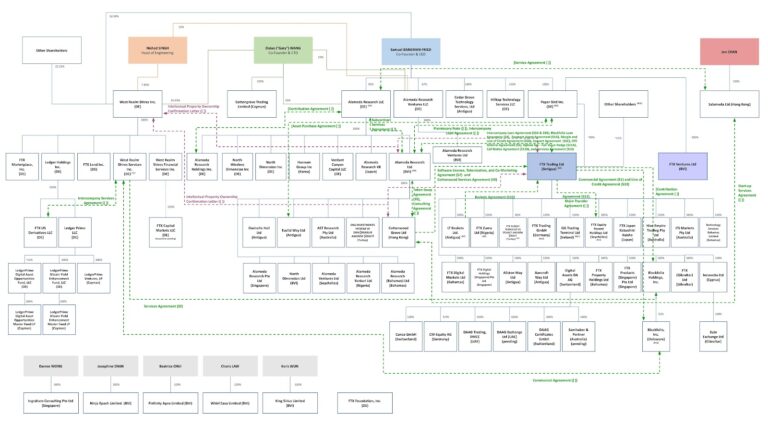

In the early stages of FTX’s bankruptcy proceedings, the restructuring team unveiled a corporate structure chart that sheds light on the complexity of Sam Bankman-Fried’s former empire. Despite having 300 employees, FTX controlled 130 companies when it filed for bankruptcy in November 2022.

While it is common for companies to have subsidiaries, a corporate structure with many such subsidiaries implies significantly more complex operations. To put this into perspective, General Motors, a multinational company with many international partnerships and diverse product lines, has 455 subsidiaries that support $156.73 billion in revenue and 167,000 employees.

To be fair, some of FTX’s affiliates served legitimate purposes. For example, it was necessary to separate the licensed derivatives business from the corporate headquarters. Also, certain markets, such as Japan, required separate entities due to market complexities. Some attribute the complexity of the FTX structure to Sam Bankman-Fried’s father, Joseph Bankman, a tax expert and professor at Stanford Law.

As Bankman-Fried’s trial is still months away, FTX has been relatively low on the agenda. Instead, Binance is facing bilateral lawsuits from the CFTC and SEC. SEC Chairman Gary Gensler drew parallels between FTX and Binance, claiming that both were mixing among other things. Also, there are similarities in the institutional structures of Binance and FTX.

Has the leading cryptocurrency bottomed?

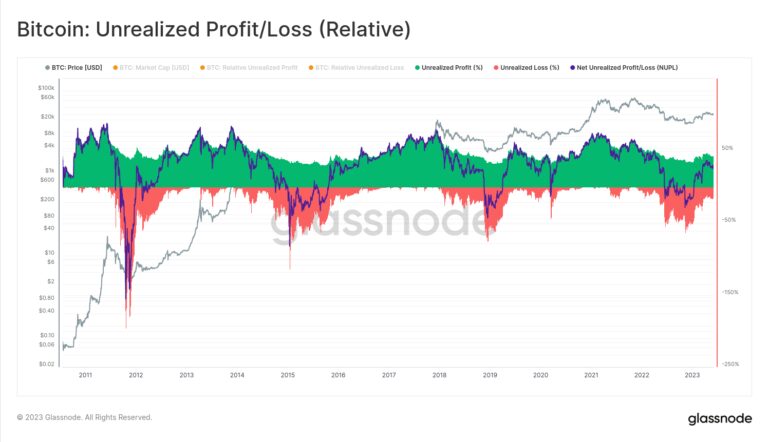

The second part of the previous year brought significant transformations in Bitcoin’s on-chain data environment, especially after the FTX market crash in November. This period saw a significant loss of life, indicating a widespread event of capitulation.

Source: Glassnode

Source: GlassnodeThe Adjusted MVRV Ratio, a key metric that measures unrealized losses in the active market, fell to an all-time low. This level is only comparable to previous market lows observed in December 2018 and January 2015.

Source: Glassnode

Source: GlassnodeAlso, the Relative Unrealized Loss, which measures the overall loss in total market capitalization, peaked at 56%. This value is reminiscent of the levels seen in previous bear market lows. These combined on-chain indicators strongly suggest that the FTX crash in November likely marked the bottom of the market.

Whales keep accumulating

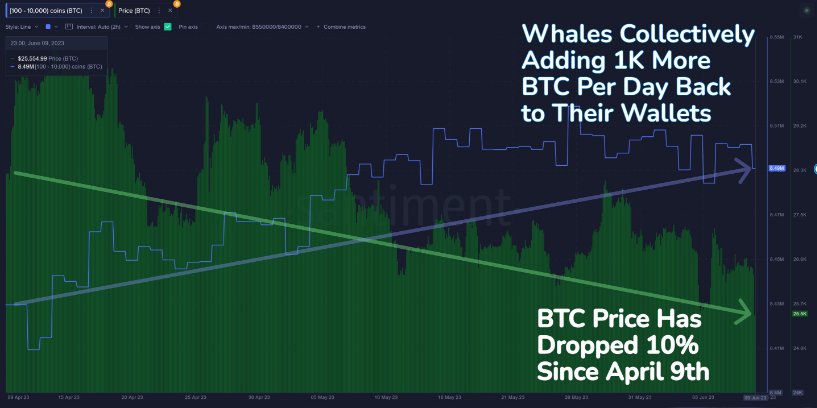

Since April 9, the Bitcoin price has fallen by 10%. Interestingly, whales holding 100 to 10,000 BTC have accumulated another 57,578 BTC over the same period.

Source: Santiment

Source: SantimentThis current trend, in which large holders increase their holdings while the Bitcoin price is in a downtrend, is surviving from previously observed patterns. Typically, whales buy during an uptrend. However, whales have been actively stocking up since mid-April, when Bitcoin hit a yearly high.

Historically, heavy whale accumulation has often coincided with bull runs or followed market lows. Are these wallets buying from the top for the first time or is the current downtrend merely a harbinger of a more significant uptrend? It is worth noting that if the whale accumulation rate continues to increase, this will affect the demand for BTC and potentially raise the price. .

Fluctuation in BTC dominance

In addition to whale accumulation, there has been a recent increase in Bitcoin dominance. This demonstrates its status as a safe haven for investors in times of market volatility.

Source: TradingView

Source: TradingViewBitcoin dominance is currently over 49%, its highest level since April 2021. This scenario means that almost half of the total value locked in the cryptocurrency market is Bitcoin. One of the factors contributing to this recent surge is the simultaneous decline in the prices of major altcoins. Tokens such as SOL and MATIC suffered significant drops of over 20% during the severe crash on a Saturday morning. By comparison, Bitcoin’s relatively stable price offers a shelter against larger losses in the market.