Once again, gold price action is stuck at neutral. According to many Wall Street analysts and individual investors, the yellow metal is waiting for a catalyst to ignite a major move that is expected to be higher.

“ I’m bullish on gold in the near term because…”

The latest Kitco Weekly Gold Survey shows individual investors continuing their bullish trend in gold. Also, traders are waiting for prices to retest the resistance just below $2,050. At the same time, Wall Street analysts are equally divided. Many say traders should distinguish between short-term volatility and the broader trend.

Ole Hansen, head of commodities strategy at Saxo Bank, says gold is “patiently bullish” in the near term as the market continues to see solid fundamental support. However, he adds that he also respects the flows in the market. Hansen says the volatility from speculative positioning will likely lower gold prices next week as investors react to US dollar short selling. Hansen adds that gold prices will remain in a solid uptrend as long as gold finds support above $1,950. In this context, the analyst makes the following statement:

I don’t think a correction towards $2,000 or below is a cause for concern. I realize that any sale will likely be position driven rather than a fundamental change in outlook.

Investors are willing to pay a higher price for gold!

Sean Lusk, co-director of commercial hedging at Walsh Trading, says gold is in a bearish trend in the near term, adding that a correction would be healthy and not surprising given the gains made over the past six months. Lusk states that he is also watching the $1,950 level. But he notes that buying the dips is likely before it reaches that level. Lusk cites broad-based economic uncertainty as providing solid support for the precious metal. For this reason, he says that it continues its long-term rise on gold.

Lusk states that if investors want to know where gold is going, they should only look back at next month’s prices. The analyst states that the gold market is currently in kontango, with December futures trading around $2,071. Gold futures contracts for June are currently trading around $2,016. From this point of view, the analyst makes the following assessment:

The market tells us that investors are willing to pay a higher price for bullion going forward. Markets expect weak economic conditions to force the Federal Reserve to cut interest rates by the end of the year.

Bulls and bears balance in gold survey

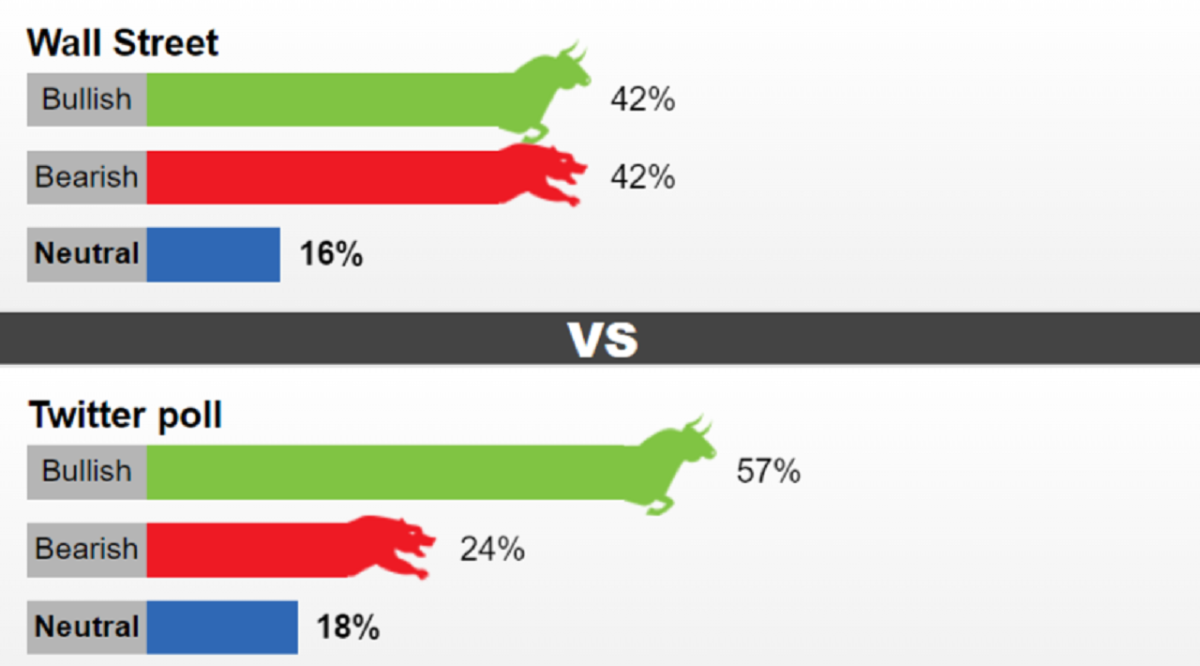

This week, 19 Wall Street analysts voted in the Kitco Gold Poll. In the voting that ended in a draw, both the bearish and bullish positions received eight votes (42%). At the same time, three analysts (16%) remained neutral on gold for next week.

Meanwhile, respondents cast 665 votes in online polls. 382 (57%) of the respondents think that gold will rise next week. Another 162 people (24%) predict that gold will fall. 121 people (18%) state that they are neutral in the near term. The survey also shows that, on average, retail investors think gold prices will close around $2,046 next week.

This development will create a pullback for the shiny metal

As recession fears continue to rise, gold continues to benefit from safe-haven interest. Some analysts state that the primary driver remains the Federal Reserve’s monetary policy and its impact on the US dollar. Analysts say gold will likely continue to be challenged as market expectations regarding the Central Bank’s monetary policies change. cryptocoin.com As you can follow, the markets continue to price rate cuts in the second half of this year. However, the Fed has signaled that it is not ready to cut interest rates as inflation remains high.

Analysts say that the US dollar will gain some value if the markets start pulling the first rate cut to the end of the year or 2024. In this context, James Stanley, senior market strategist at Forex.com comments:

The US dollar is testing resistance and has been holding support for several months. I think we will see higher prices tested in DXY. This will create a pullback for gold. Thus, the yellow metal will test below $2,000. I have a pretty big support at $1,981. So I want to see how you react there.

Neutral viewers explain their reasons

Darin Newsom, senior market analyst at Barchart.com, says he hates being neutral in the weekly poll. However, he notes that the momentum indicators he watches are relatively flat. “It looks like gold may want to stay in this area until near the end of the month,” Newsom said. “We’ll probably see what happens next on the long-term monthly chart for the cash index,” he says.

Adrian Day, head of Asset Management, also explains that he is neutral on gold in the near term. But he says it’s only a matter of time before prices start to rise. Therefore, he considers the following explanation appropriate:

It is clear that the US economy is heading towards a recession and there are still troubled companies in the financial sector. The second, if not the first, will cause the Fed to pause before inflation consistently falls below its 2% target. This is a very bullish scenario for gold. I suspect we’ll see another week or two of these oscillations before we break out.