On September 15, 2022, Merge took place, the first of the upgrades to improve Ethereum’s scalability, security, and sustainability.

What Are These Upgrades?

- The Merge:Upgrades for moving from Proof of Work to Proof of Stake

- The Surge:Scalability-related upgrades with sharding and rollups

- The Scourge:Update that fixes issues related to Maximal Extractable Value (MEV)

- The Verge:Upgrades for easier confirmation of blocks

- The Purge:Upgrades to reduce the computational costs of nodes and simplify the protocol

- The Splurge:Other upgrades

With Merge, the Ethereum network has transitioned from a Proof of Work (PoW) consensus mechanism to a Proof of Stake (PoS) consensus mechanism. Thus, it reduced high energy consumption by 99.5% and problems such as increased costs of mining hardware were eliminated.

What is the Shapella Upgrade?

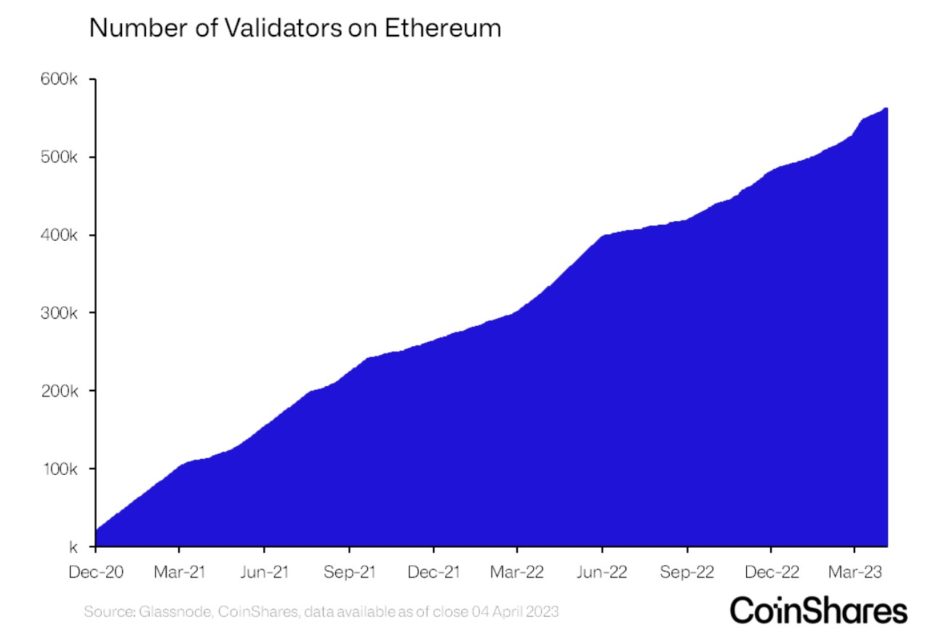

Shapella is a phase of Ethereum 2.0 and an upgrade designed to make the network run faster and more efficiently. With the Shapella upgrade, over 560,000 validators on the network will be able to withdraw their staked ETH and accrued staking rewards. That is, about 15% of the total supply, about 18 million Ether (ETH) will be released.

Overview of Staking System

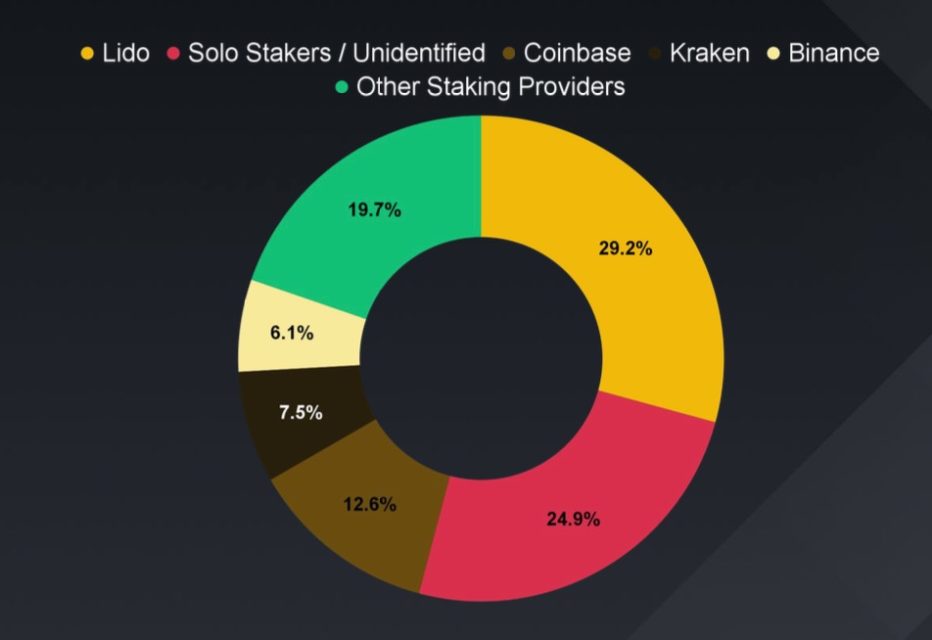

While 32 ETH is required to run a validator, people with less than 32 ETH can also enjoy staking returns by joining staking pools like Rocket Pool, Lido or a centralized exchange like Coinbase, Binance.

Is There Selling Pressure?

In fact, there are some factors that reduce the selling pressure. Only 44% of validators set 0x01, which is required to enable both partial and full withdrawals. Partial withdrawals (only for validators who want to claim rewards) happen automatically once a week, while for validators who want full withdrawals, the process is a bit longer because they have to queue up.

Lido, the largest liquid staking platform, has announced that their withdrawal functionality will not be available until early May as they are preparing their v2 upgrades.

The locks on Binance will be opened one week after the upgrade and withdrawals can be made with the determined quotas.

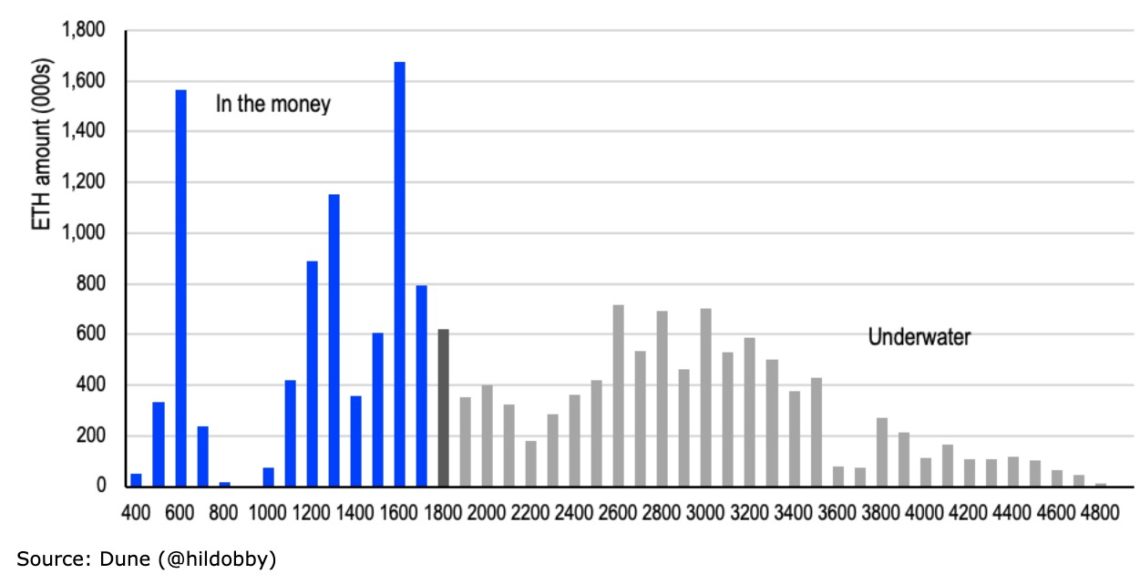

Also, 51% of ETH stakers are locked in higher prices than they are today. All this can prolong the withdrawal time of staked ETH balances.

A successful upgrade can encourage people to stake ETH as it removes liquidity risk and uncertainty. If the withdrawals are high, the rewards will increase and it will present a good opportunity to the investors in the current market conditions.