An obscure crypto-market metric known as the “stETH discount” is suddenly sending a distress signal, possibly due to speculation that the troubled lender Celsius is preparing to dump some of its holdings in a bid to raise liquidity.

The discount represents the difference between the price of ether (ETH), the second-largest cryptocurrency, and the “stETH” token, which is a derivative of ether and is supposed to have a similar price.

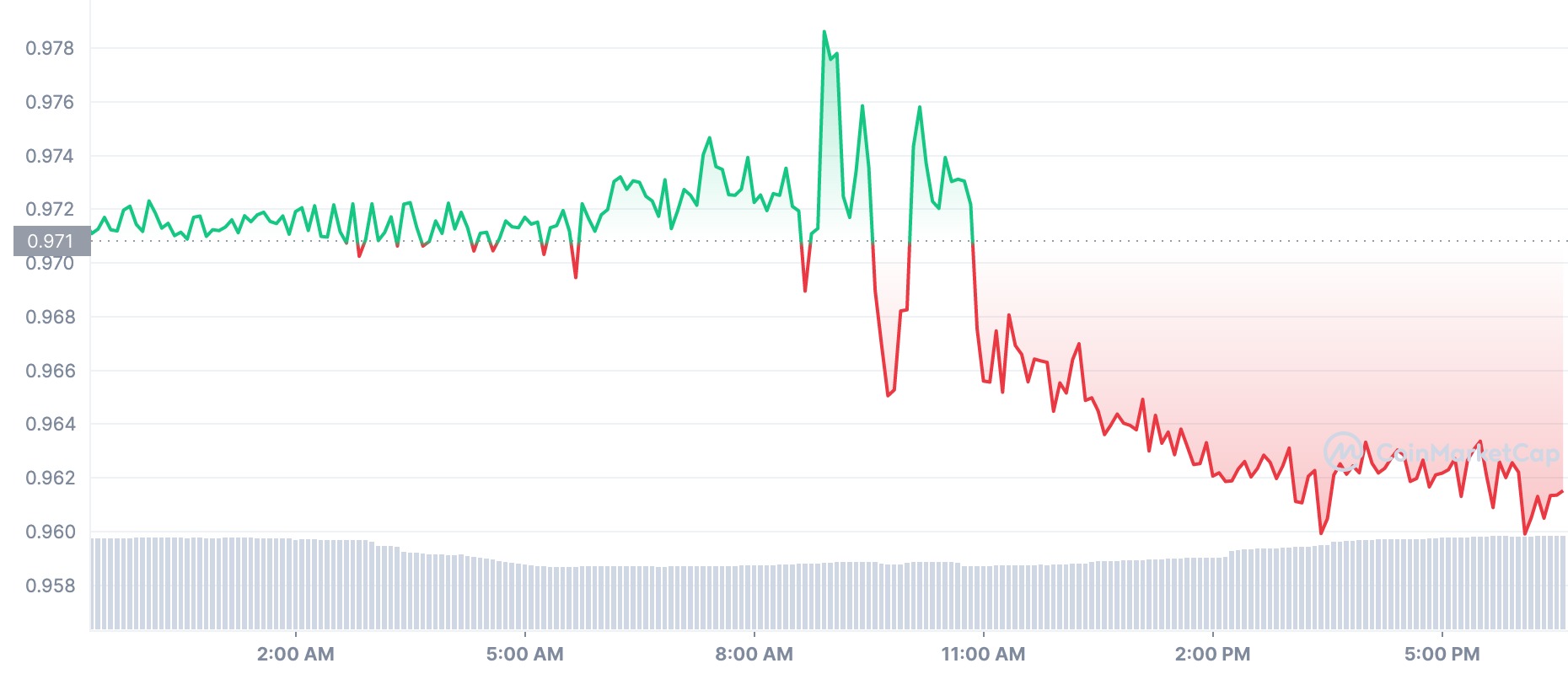

But on Tuesday, the discount widened from 2.6% to 4%, the highest since early July. The figure remains below the all-time high of 8% recorded in June – the week when Celsius suspended withdrawals and crypto hedge Three Arrows Capital blew up.

Market watchers are paying close attention to Celsius partly because the liquidity-strapped crypto lender is one of the largest single holders of the stETH token. So if it dumps that stake, the price of stETH could come under heavy pressure – even if the price of ether remains aloof.

The sudden impetus comes from blockchain data showing that Celsius on Tuesday paid off debt on the decentralized finance protocol Aave, and in exchange received back 416,000 stETH tokens ($435 million worth at current prices) that had been pledged as collateral.

The stack represents almost 10% of the total supply of stETH, which stands at 4.2 million. The total market capitalization of stETH is $4.3 billion, according to CoinGecko.

“The stETH position poses significant price risk to the market among the yield-bearing collateral that Celsius had,” Fundstrat analyst Walter Teng told CoinDesk.

The discount on stETH to ether’s price jumped to 4% Tuesday, the highest in July. (CoinMarketCap)

Read more: How Crypto Lender Celsius Overheated

How Celsius got trapped in stETH

The price gap between stETH and ETH has become a closely-followed metric of the stress crypto markets endure lately.

The stETH token represents 1 ether (ETH) token deposited to the staking platform Lido to earn a 4% annual yield for locking up in Ethereum’s upcoming proof-of-stake blockchain.

The caveat is that staked ETH cannot be redeemed in the foreseeable future, until well after Ethereum successfully completes its planned technological transition to a “proof-of-stake” blockchain, colloquially referred to as the Merge. Those investors who stake ETH on Lido receive the equivalent in stETH tokens, which they can use as collateral to take out loans.

Celsius was one of the depositors on Lido, locking up its ETH to earn a yield and using stETH to “recursively borrow” on the DeFi lending platform Aave, as David Duong, head of institutional research at crypto exchange Coinbase wrote in a report.

Read more: Crypto Market Chaos: No, Lido Is Not ‘the Next Terra’

Ether and stETH tokens changed hands at a one-to-one ratio up until the billion-dollar implosion of the Terra network and its UST stablecoin in May, which kickstarted the credit crisis among crypto firms.

Then, stETH’s price further deviated from the price of ETH as crypto firms such as Alameda Research, Amber and insolvent Three Arrows Capital dumped their holdings in a sign of liquidity crunch.

Celsius was among the dumpers during that episode, a report by blockchain data firm Nansen found.

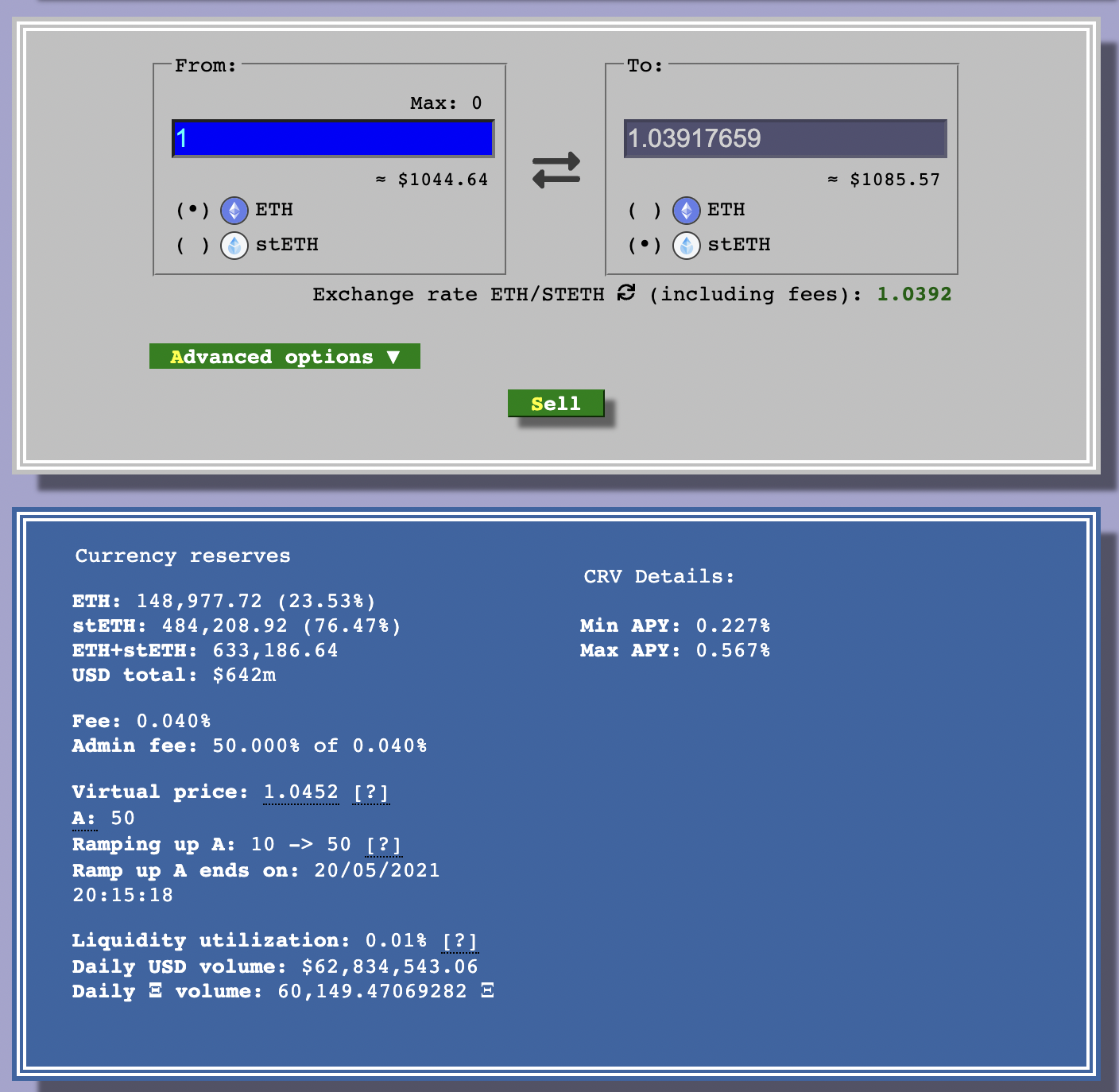

The primary market these institutions used to get rid of stETH is an exchange pool on the decentralized finance protocol Curve, where users can swap their tokens for ETH.

Yet the earlier round of stETH dumping left the Curve pool mostly drained and heavily imbalanced, shrinking to a fraction of the size it once had. At press time, it holds about 150,000 ETH and 484,000 stETH, an imbalance with staked ether accounting for 76% of the liquidity while ether accounting for the rest.

This makes it impossible for Celsius to dismantle its 416,000 stETH position in the Curve pool alone, because there isn’t have enough ETH tokens to swap into.

The biggest market where someone can exchange stETH to ETH is largely drained and heavily imbalanced. (Curve)

What Celsius might do with its stETH

Celsius is one of the slew of crypto lenders facing liquidity issues lately. Vermont’s Department of Financial Regulation (DFR) alleged that the lender “is deeply insolvent,” while regulators in several other U.S. states launched investigations.

Read more: Looking at the Claims Celsius Operated Like a Ponzi

Celsius moved all of its publicly-known stETH holding to an unknown wallet earlier Tuesday, as CoinDesk reported, raising questions about what it intends to do with it.

Last week, after paying off its debt to DeFi platform Maker to reclaim $440 million in wrapped bitcoin (WBTC) tokens, the lender deposited the tokens to crypto exchange FTX.

If Celsius wanted to pursue a similar strategy with its freshly unlocked stETH stack, it faces a more difficult challenge as the market for stETH is fragmented, and the Curve pool is too shallow to unwind the position.

“To offload their stETH exposure, Celsius would have to carefully structure trades across DeFi, centralized exchanges, and any counterparties they can find,” John Freyermuth, analyst at Enigma Securities told CoinDesk.

This might include seeking “requests for quotations from over-the-counter desks that are willing to undertake this liquidity risk,” Teng added, possibly at a discounted price.