The gold price’s excursion above the $1,900 level was short-lived. April Non-Farm Employment Data from the USA will be the last important data of the week. We have compiled the evaluations and analyzes of world-renowned analysts who put gold on the table for our readers.

“Bond yields are the main factor affecting the gold price”

Commerzbank economists state that the employment report is unlikely to affect the gold price unless it deviates significantly from expectations and make the following assessment:

Gold is set to post its third weekly loss in a row. Bond yields are probably the main factor affecting gold. As market-based inflation expectations did not change, real interest rates also increased significantly. This made gold less attractive as an alternative investment.

Market participants will turn their attention this afternoon to the United States, where the official labor market report for April will be published. Bloomberg consensus expects the number of jobs created to be lower than in recent months. However, according to Commerzbank economists, data can only have a noticeable impact on the price of gold if it deviates significantly from expectations.

“There are not many participants with an appetite for gold”

Kriptokoin.com As we have given, the US Federal Reserve decided to increase the policy rate by 50 basis points (bps) as expected. As a result, gold rose. However, economists at TD Securities don’t expect the higher race in the yellow metal to last long. Here’s how economists explain their view:

The Fed largely lived up to expectations and stepped up a buy-everything rally given the prevailing weak mood in global markets amid the good news moves. Price action plays out according to our playbook, which states that there aren’t many participants with an appetite to buy gold and only a few participants are missing. On the long side of the consensus trade, there are still some indifferent gold positions associated with the war in Ukraine.

According to economists, the few remaining short positions have a large position size and are likely to profit as prices rise. The buy-everything trade is also fueling the ongoing rally in gold, economists said. However, economists comment:

However, considering that traders’ shorts are close to record lows, we suspect that the rally will not last long in the yellow metal.

“Any recovery attempt can be seen as a selling opportunity”

Market analyst Haresh Menghani, overnight on Wall Street He notes that the spillover effect from the large sell-off has weighed on investor sentiment, which is evident from a softer tone in the equity markets. This, too, was seen as a key factor giving some support to the safe-haven gold, although any meaningful upside movement remains uncertain amid expectations of further policy tightening by the Fed.

Fed Chairman Jerome Powell said on Wednesday that a 75 basis point rate hike is not being considered actively, but policymakers are ready to approve a 50 percentage point increase at future meetings. Also, markets are still pricing in a 200 basis point rate hike for the remainder of 2022, which continues to support rising US Treasury bond yields.

Apart from that, the analyst states that the underlying bullish sentiment surrounding the US dollar, which has remained steady near its two-year high, is acting as a headwind for dollar-denominated gold. However, the downside seems to have eased, as investors waited on the sidelines before the closely watched US monthly employment data is released, according to the analyst. The popularly known NFP report is expected to be consistent with tightening labor market conditions and likely to support further Fed rate hikes. The analyst comments:

This, with fresh selling emerging on Thursday, suggests that the path of least resistance for non-yielding gold is to the downside, and any attempt to recover could be viewed as a selling opportunity.

Pablo Piovano: Gold could drop to $1,850

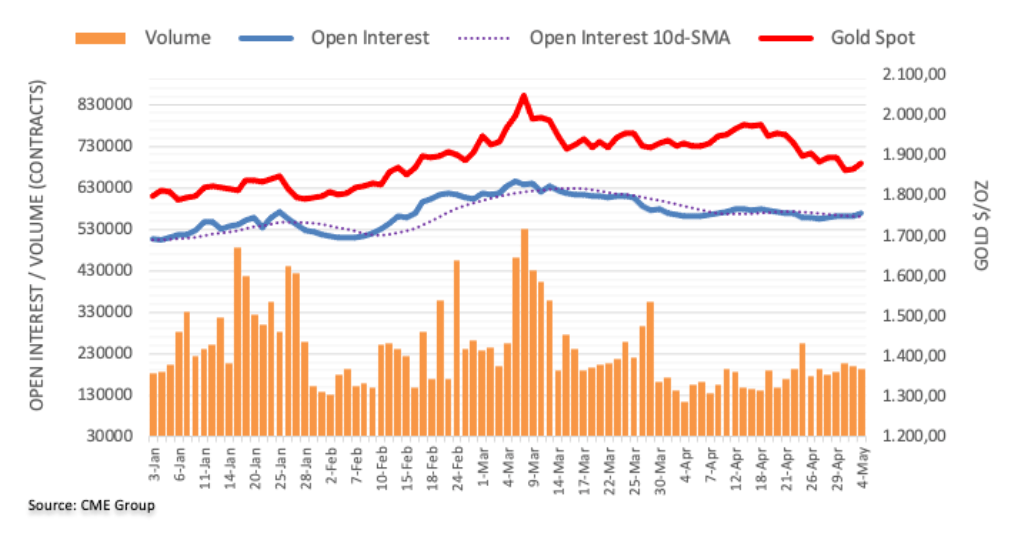

Gold futures markets open interest, this time around 14% for the third session on Thursday, according to CME Group’s forecast. 7,000 contracts increased. Volume followed suit, with nearly 56.8k contracts rising after two consecutive days of pullbacks.

Gold prices failed to break past the $1,900 level on Thursday and closed the session with modest losses. The decline was amid rising open interest and volume, revealing more weakness in the very near term with the close target at $1,850, according to market analyst Pablo Piovano.