According to Blockware analyst Will Clemente, a crucial moment is approaching for the leading crypto as Bitcoin could lose $20,000 if it falls from the range it has consolidated over the past 5 days.

Will Clemente explains how Bitcoin price will drop to $19,000

As the chart shared by Clemente suggests, Bitcoin is currently trading at the 200-week MA support line and the 19,000 range. This region is the only range that has prevented Bitcoin from falling below $19,000.

Basically either bounce here or its likely headed for range lows.

Would become short-term bearish if falls back into the range. (below purple box) https://t.co/nVOxj84Ht7 pic.twitter.com/plllDPvQQL

— Will Clemente (@WClementeIII) July 23, 2022

A possible drop below $22,000 will take Bitcoin back to levels it hasn’t seen in the past two weeks. The main problem with BTC’s current state is that it lacks short-term support to protect it from falling once again. Fortunately, technical analysis shows that Bitcoin is consolidating above $22,000. Entry data and trading volume are still rising, which are direct signals of continued support for Bitcoin by the bulls. This positive view is supported by the famous manager Raoul Pal.

Former Goldman Sachs executive says the market is poised for a comeback

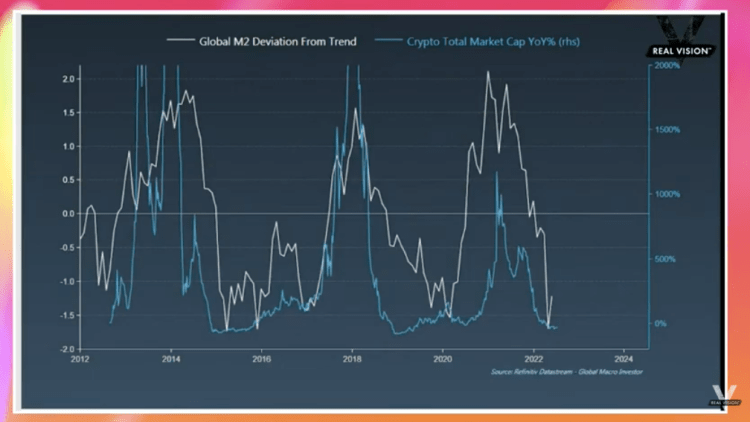

Raoul Pal says the crypto market is poised for a major upside reversal. In his latest analysis, he says cryptos are mostly driven by liquidity from the M2 coin supply. The M2 money supply represents roughly the total amount of money in circulation plus highly liquid non-cash assets that are close to or easily convertible into cash.

Many crypto investors focus on Bitcoin halving periods, when the amount of BTC issued per block is halved. But Pal says M2 likely plays a bigger role:

Crypto is not driven by the business cycle, but by global liquidity. So this is the global M2 deviation from the trend. So the rate of change of M2 and how far it is from the trend. And it’s about one and a half standard deviations away from the trend and rising.

Raoul Pal goes on to say that these cycles do not always bring Bitcoin back to its original position:

Both the top and bottom then lead to returns in the crypto markets as liquidity drives crypto. Remember, this is not a cyclical asset, so it doesn’t go back to where it was like oil and commodities. This is a network adoption pattern that goes up and to the right over time with large volatile bands.

The expert also adds that Bitcoin does not need halving cycles to reach its peak prices again:

Many people have the narrative that it is driven by the halving. Now perhaps halving, which is a decrease in supply every four years in Bitcoin, is a factor as it relates to liquidity. So what you’re doing is you put more liquidity into the markets, causing more people to allocate capital to a low-supply environment that cuts capital in half. You don’t need half as a necessary messenger.