XRP Coin lost its market value to 144 billion dollars by losing 4 %in the last 24 hours and 21 %in the last month. This decline is supported by the lowest level of the Chaicine Money Flow (CMF) indicator to its lowest level since June 2022 and a decrease of active addresses by 53 %.

XRP Coin Price Sales Print Experiences

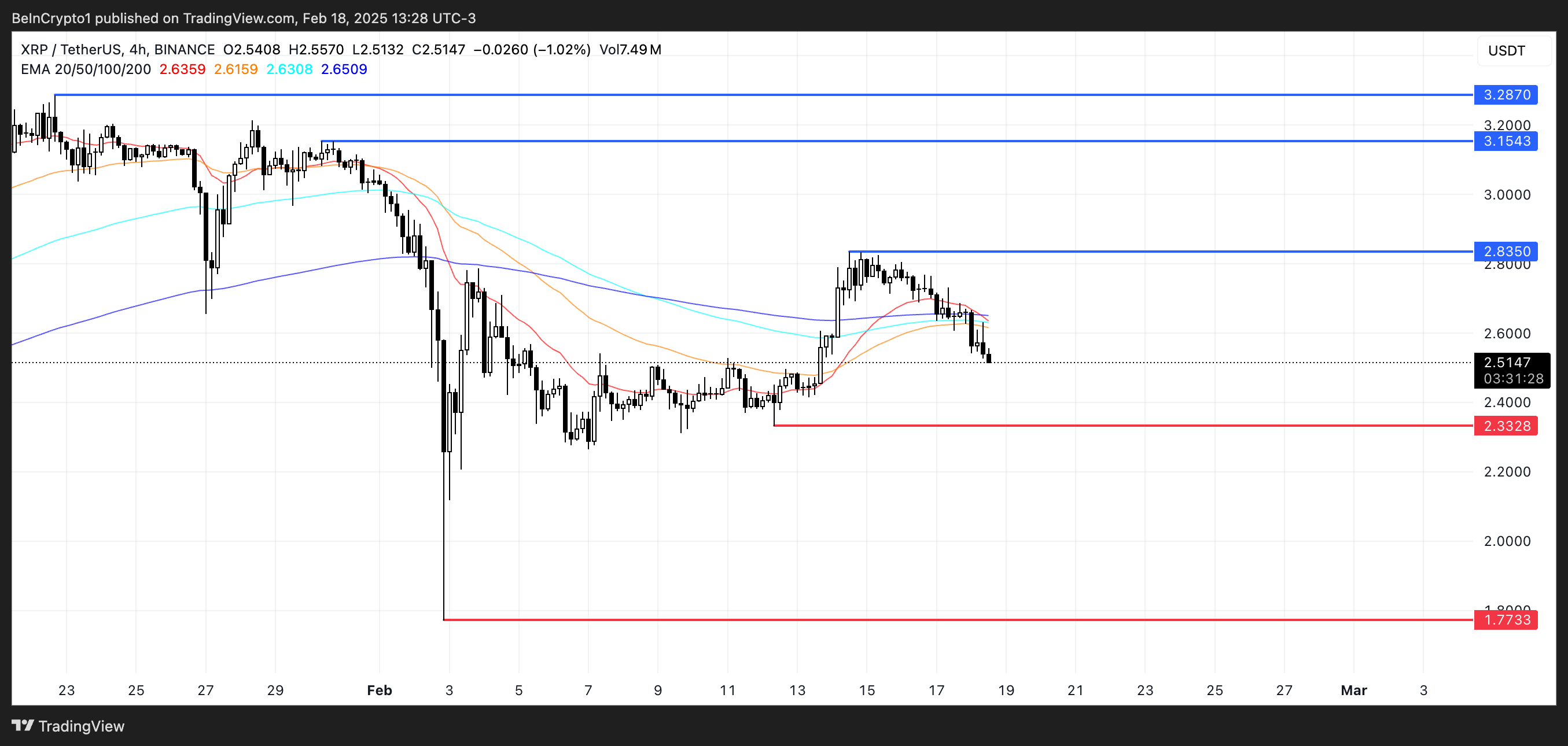

Technical indicators indicate that the price of the XRP Coin price may continue. In particular, the XRP’s exponential moving average (EMA) lines create the risk of further decrease by creating a death cross.

With the weakening of the price acceleration, the XRP Coin is on a critical threshold. Investors closely follow whether the price can stability at these levels, or whether there is a deeper risk of correction.

As shown in the graph above, XRP’s Chaicine Money Flow (CMF) indicator decreased to -0.27, decreasing 0.30 in the last three days. This indicator measures purchase and sale pressure by analyzing price and volume. Values above zero show the accumulation and the values below show the distribution.

The continuous decline in CMF reveals that more than the capital entering the XRP has increased and sales pressure has increased. Historically, long -term negative CMF levels have pointed to the decline trends extending for XRP.

The fact that the CMF indicator remains in the negative area or further decreases may increase the likelihood of deepening price losses. However, if the CMF signal signal and moves towards zero, the bulls may have the opportunity to dominate the market again.

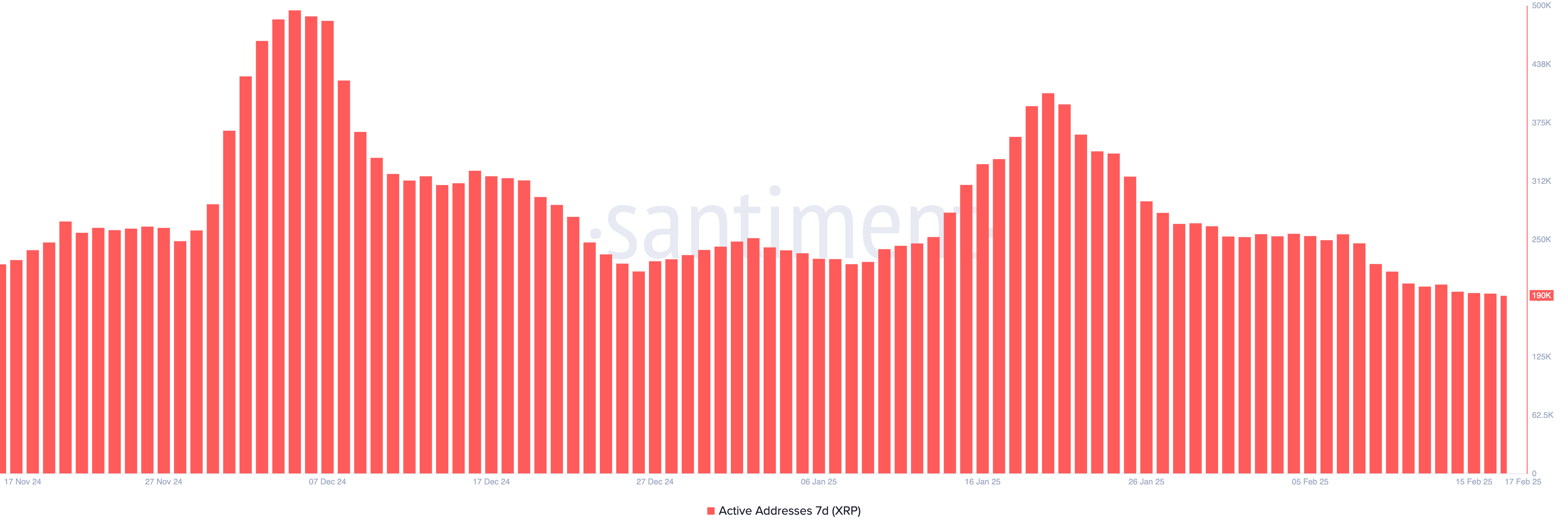

Activity in the XRP network fell 53 %

The number of 7 -day active addresses of the XRP decreased to 190,470 on January 20, while 407,000 decreased by 53 %. This indicator measures the number of unique addresses that process at a certain period of time and is an important indicator of network activity. Such a sharp decrease may indicate that investors’ interest is reduced or the demand for transactions has fallen.

A decrease in network efficacy usually weakens market mobility and liquidity, which can cause the price to decrease.

The number of 7 -day active addresses of the XRP had decreased to such low levels on 14 November 2024. If this decrease continues, the investor confidence may weaken and rise movements for XRP may be limited. However, recovery in active addresses can support the price movement by reviving the interest in assets.

Can the XRP price drop 29 %further?

XRP’s EMA lines form the intersection of death. This occurs when short -term moving averages go under long -term moving averages and often indicate that the downward trend is strengthened.

If the sales pressure increases, the XRP CoIN may take an important support test at $ 2,33. Breaking this level can push the price up to 29 %, up to $ 1.77.

On the other hand, if the XRP coin gives signals and starts upward movement, the resistance point of $ 2.83 can be exceeded. This can allow the price to move towards $ 3.15. For the time being, the market observes how XRP will react against sales pressure.

To be aware of last -minute developments Twitter ‘ in, Facebookin And Instagram follow and follow Telegram And Youtube Join our channel!