Bearish sentiment in the broader market has weighed down on tokens that may were otherwise fueled by positive fundamentals as traders look to take profits on price movements instead of taking a buy-and-hold approach.

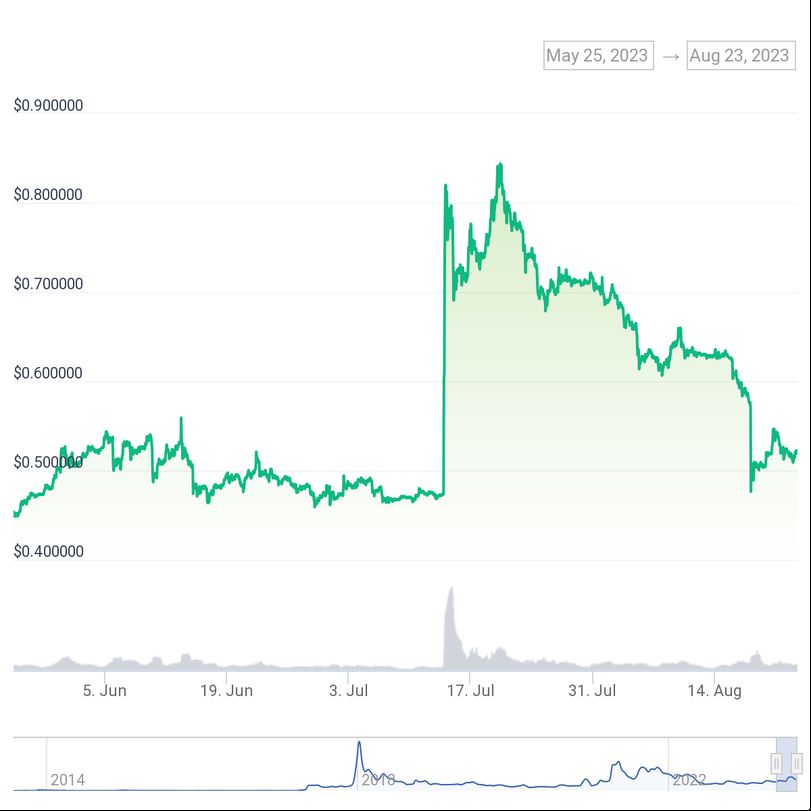

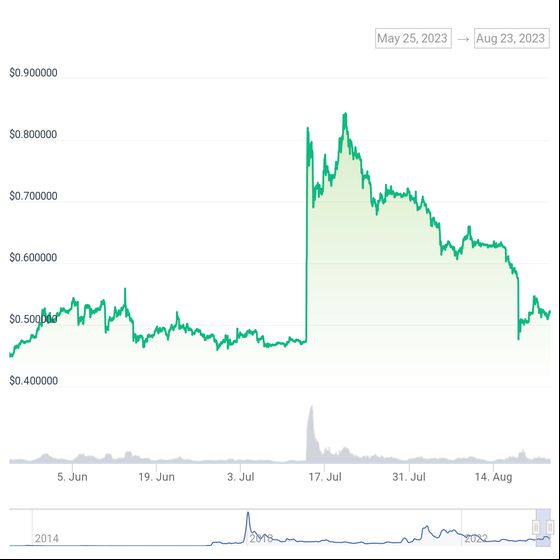

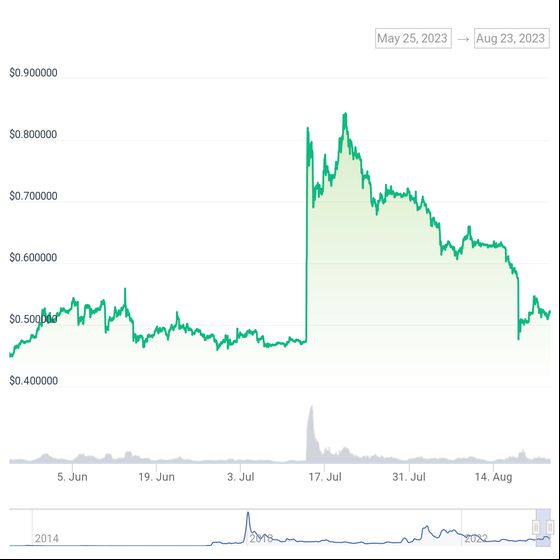

Data shows XRP, among the world’s largest tokens by market capitalization, has lost nearly all gains after Ripple Labs’ landmark court ruling over the U.S. Securities and Exchange Commission (SEC) in July.

XRP exchanged hands at 50 cents on Wednesday, down 14% in the past week and 30% over a 30-day period. Price-chart data shows the tokens hit a yearly high of 83 cents on July 20., but Wednesday’s prices are back to levels before the SEC ruling.

In 2020, the SEC sued Ripple on allegations that the firm sold unregistered securities. Ripple has historically maintained a distance from XRP, the token that powers some of its products, and the XRP Ledger network. But any progress in the case has an impact on XRP prices.

But in July 2023, a U.S. judge ruled the sale of XRP tokens on exchanges did not constitute investment contracts, putting a pause on what was one of the longest and most controversial legal cases in the crypto market.

Appeals on that ruling continue, however.