XRP Options Market Overview

The payments-focused cryptocurrency XRP experienced a significant surge, reaching a peak price of $3.40 in January. However, it has since seen a notable decline, dropping approximately 30% to its current value of $2.40.

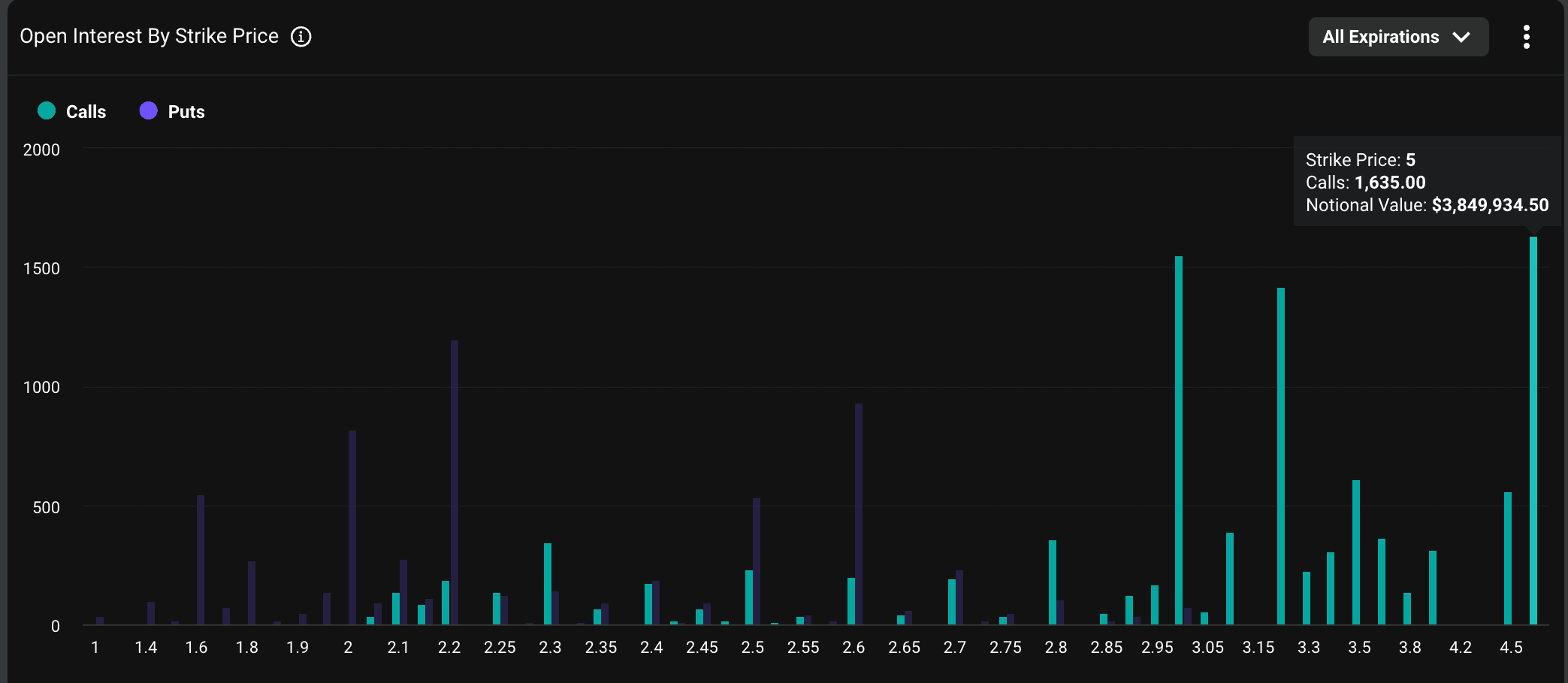

Despite this downturn, traders are still showing interest in bullish strategies. The $5 call option has emerged as the most popular bet on the Deribit exchange, indicating potential upside for buyers if the price surpasses this level. Interestingly, this trend does not necessarily reflect an outright bullish sentiment among all traders.

As of now, the $5 call option leads the market with a notional open interest of $3.84 million, making it the highest among all XRP strikes on the platform, as reported by Deribit Metrics. Notional open interest represents the total dollar value of all active options contracts at any given moment. On Deribit, each options contract corresponds to one XRP.

According to Lin Chen, the Head of Asia Business Development at Deribit, “Most of these are covered calls.” This insight helps explain the significant accumulation of open interest for these out-of-the-money (OTM) call options.

The covered call strategy involves traders selling higher-level OTM calls while simultaneously holding the underlying asset—in this case, XRP. This tactic enables traders to earn premiums from the sale of the call options while also mitigating potential losses stemming from an unexpected rally in the market.

This strategy not only allows for enhanced yield generation on top of current holdings but is also widely adopted in traditional financial markets, as well as in the trading of major cryptocurrencies like Bitcoin and Ether.