In the last week, XRP attracted the attention of investors by showing an increase of close to 10 %. However, over -chain data indicate that XRP may be over -valued. If investors have an opportunity and turn to profit sales, the price may face a serious correction.

Over -valuation risk for XRP?

XRP’s market value / real value (MVRV) ratio is currently 7.21 %. This shows that the market value of XRP is high compared to the cost of investors.

Historically, high MVRV levels triggered profit sales and led to price decreases. A similar scenario can be realized in the current case. If investors begin to sell to realize their profits, the XRP supply increases and the pressure on the price increases.

Where can profit sales attract XRP?

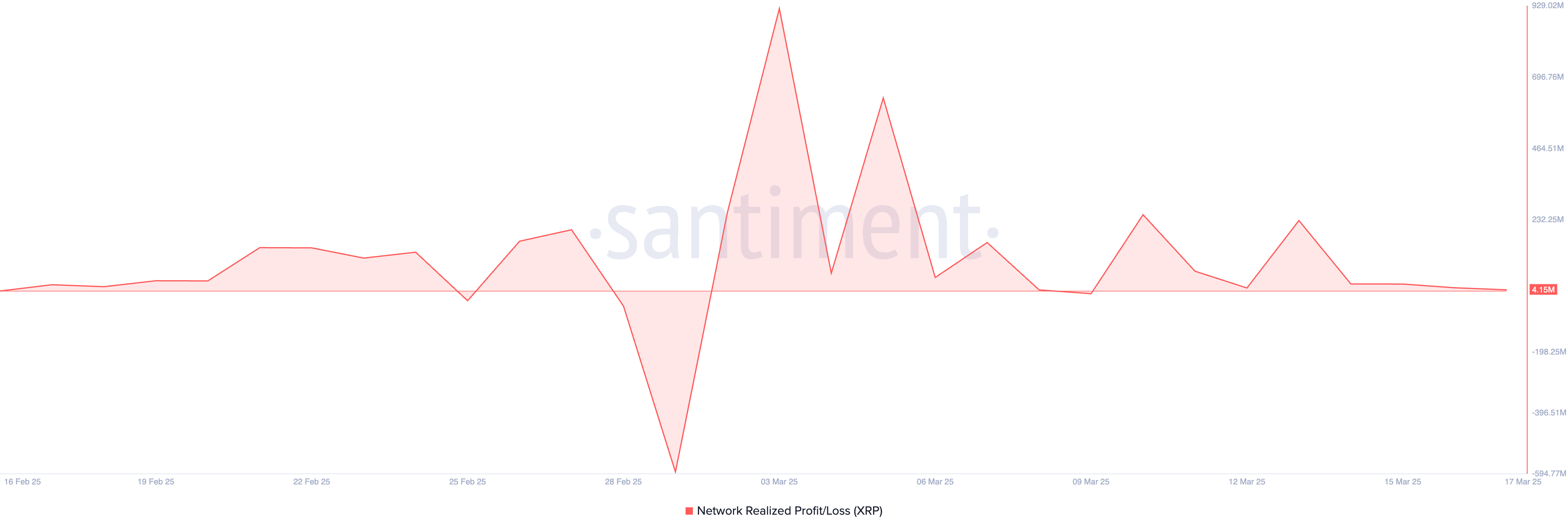

The Network of XRP’s Network Profit/Loss (NPL) indicator also shows that sales pressure increases. This indicator, which is currently 4.15 million, indicates that many investors are profitable and that there is a suitable environment for sales.

If profit sales continue, XRP may drop to $ 2.13 before. If this support is broken, sales pressure may increase and the price may decrease to $ 1.47.

Can the rise scenario continue?

It is currently traded at $ 2.30 and has experienced a 3 %loss in the last 24 hours. However, if the bulls take control, the price may increase to $ 2.61.

In order to realize this, market sensitivity should change and procurement pressure should be increased. Whether the XRP can maintain $ 2.13 support level will be the most critical element to determine the price direction.

How will the movements of whales affect the XRP price?

Big investors, ie whales, can directly affect price movements when they make strong purchase or sale in the market. According to the latest chain data, some large XRP addresses are directed to the sale of profits. If these sales are accelerated, the XRP price may experience a harsh correction.

However, some whales are known to tend to buy when they approach the price bottom levels. If the XRP receives a strong purchase response at $ 2.13, a new wave of recovery may start in the market and bulls can move the price up again.