Market Update: Caution Amidst Altcoin Movements

The cryptocurrency market appears to have found a semblance of stability; however, traders are proceeding with caution, especially when dealing with altcoins like XRP. While some capital continues to flow into the market leader, Bitcoin (BTC), the general sentiment remains tentative.

Payments-focused XRP, which is utilized by Ripple to streamline cross-border transactions, has experienced a notable increase of over 3%, now trading at $2.24. This rise has been largely fueled by optimism surrounding the potential conclusion of the ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC).

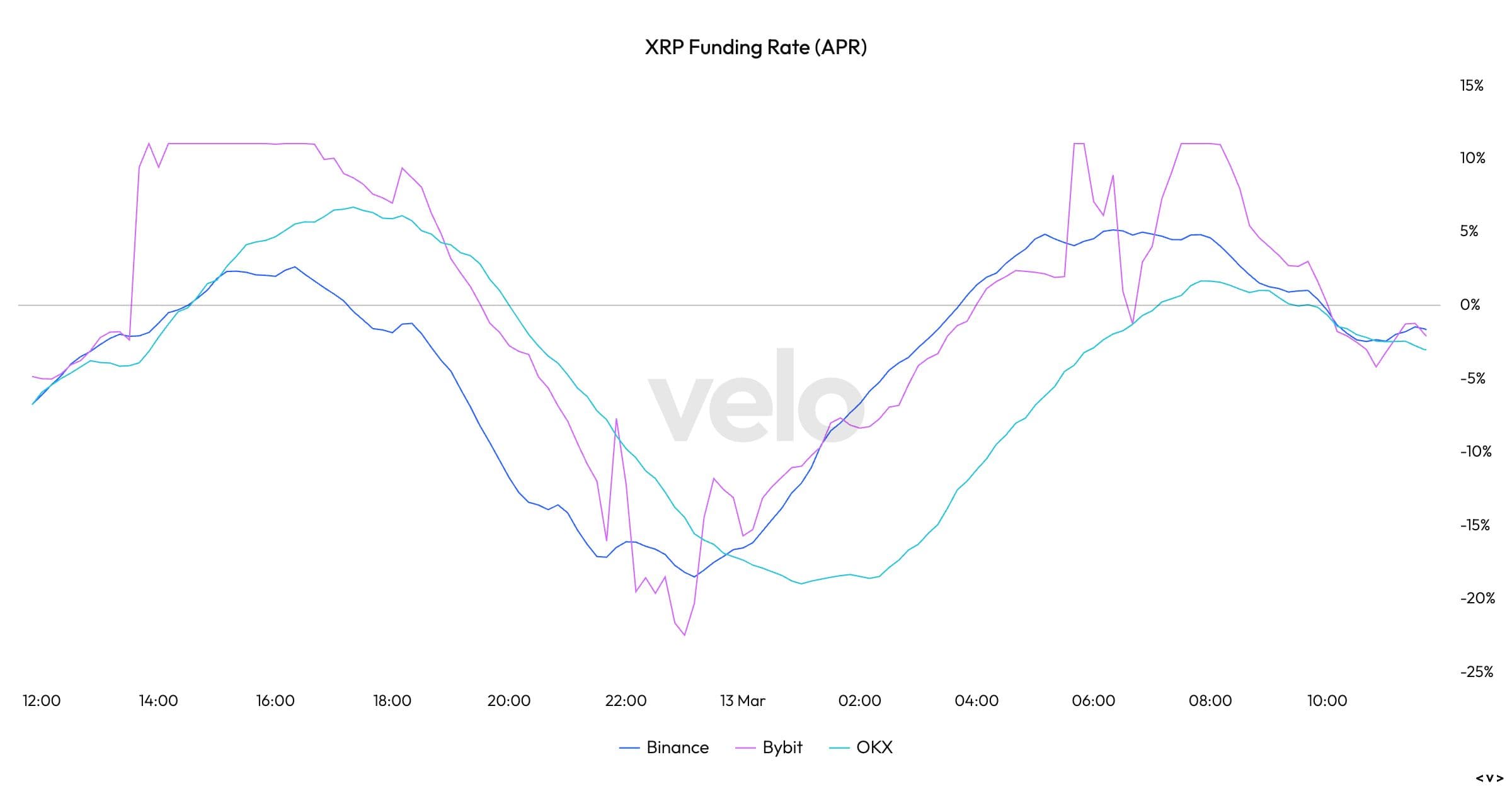

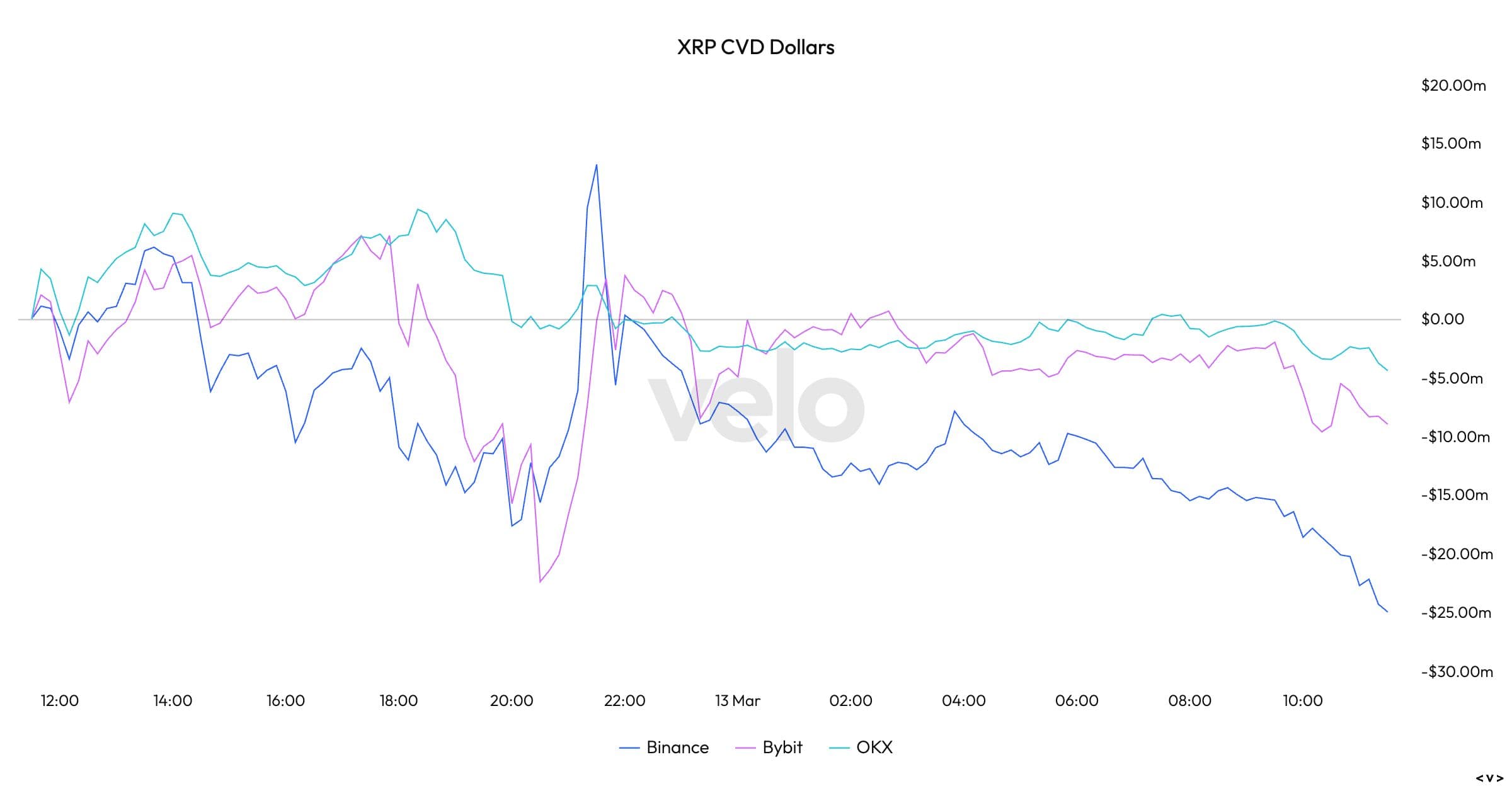

As XRP’s price climbs, the cumulative open interest in perpetual futures across major exchanges has stabilized at approximately 1.35 billion XRP. Data from Velo reveals that annualized funding rates and cumulative volume delta are both showing negative trends. Negative funding rates indicate that short sellers are paying fees to maintain their bearish positions, highlighting the prevalence of short positions in the market.

The negative cumulative volume delta (CVD), which assesses net capital inflows, suggests that the volume of selling has outstripped that of buying. This trend could be indicative of an emerging bearish sentiment within the market.

At the time of writing, several other prominent tokens, including DOGE, SOL, SUI, HBAR, LTC, BTC, TRX, and HYPE, are also displaying negative CVDs over a 24-hour period.

Technical Indicators and Bearish Trends

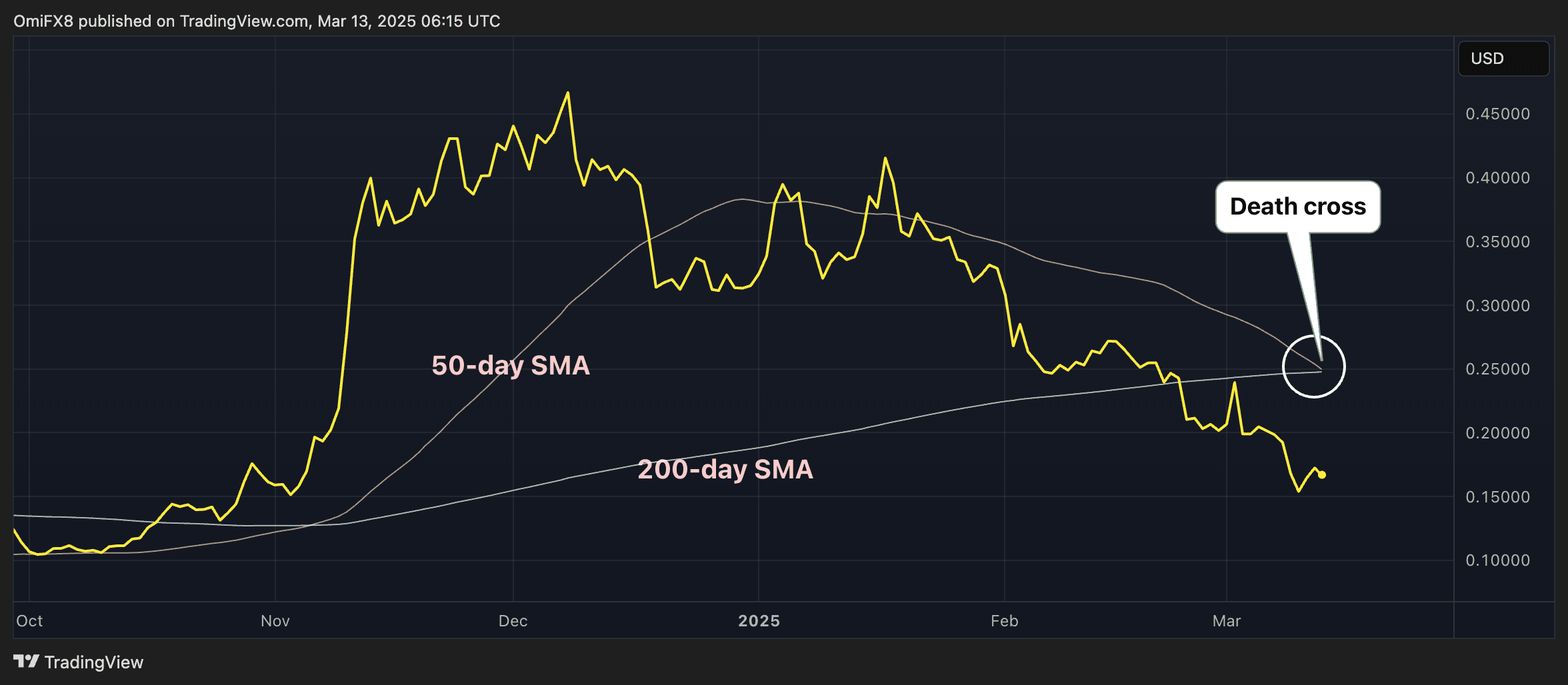

In relation to DOGE, the token is on the verge of a significant technical development as its 50-day simple moving average (SMA) is set to cross below the 200-day SMA, confirming what is known as a “death cross.” This pattern, which sounds ominous, suggests that short-term price momentum is lagging behind long-term momentum, potentially signaling the onset of a major bearish trend.

Such SMA crossovers are closely watched by trend traders; thus, the confirmation of a death cross may introduce additional selling pressure into the market. However, it’s important to note that long-term SMA crossovers are typically lagging indicators, reflecting past price movements and having a mixed success rate in predicting future shifts in the BTC and ETH markets.

It’s worth mentioning that DOGE has already experienced a significant decline, dropping 65% from its peak of over 48 cents in December.

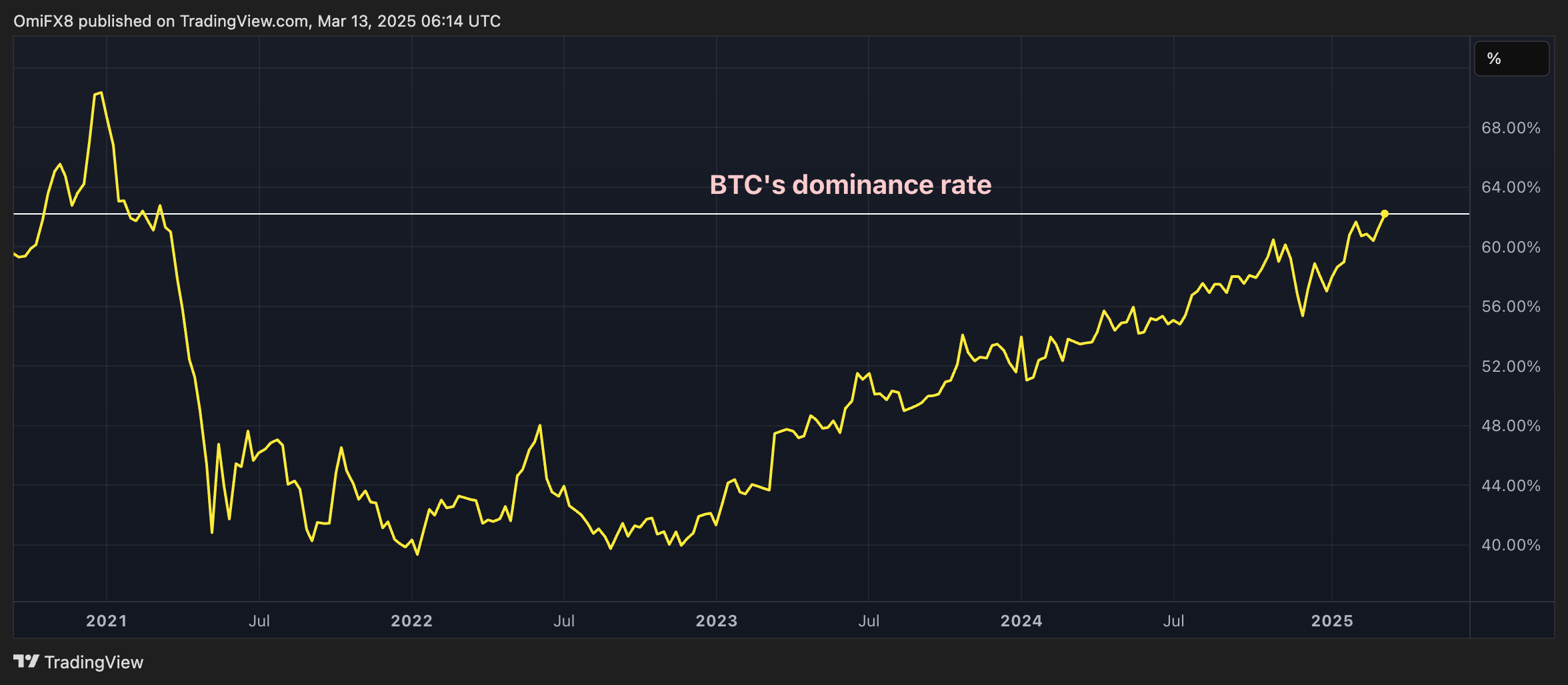

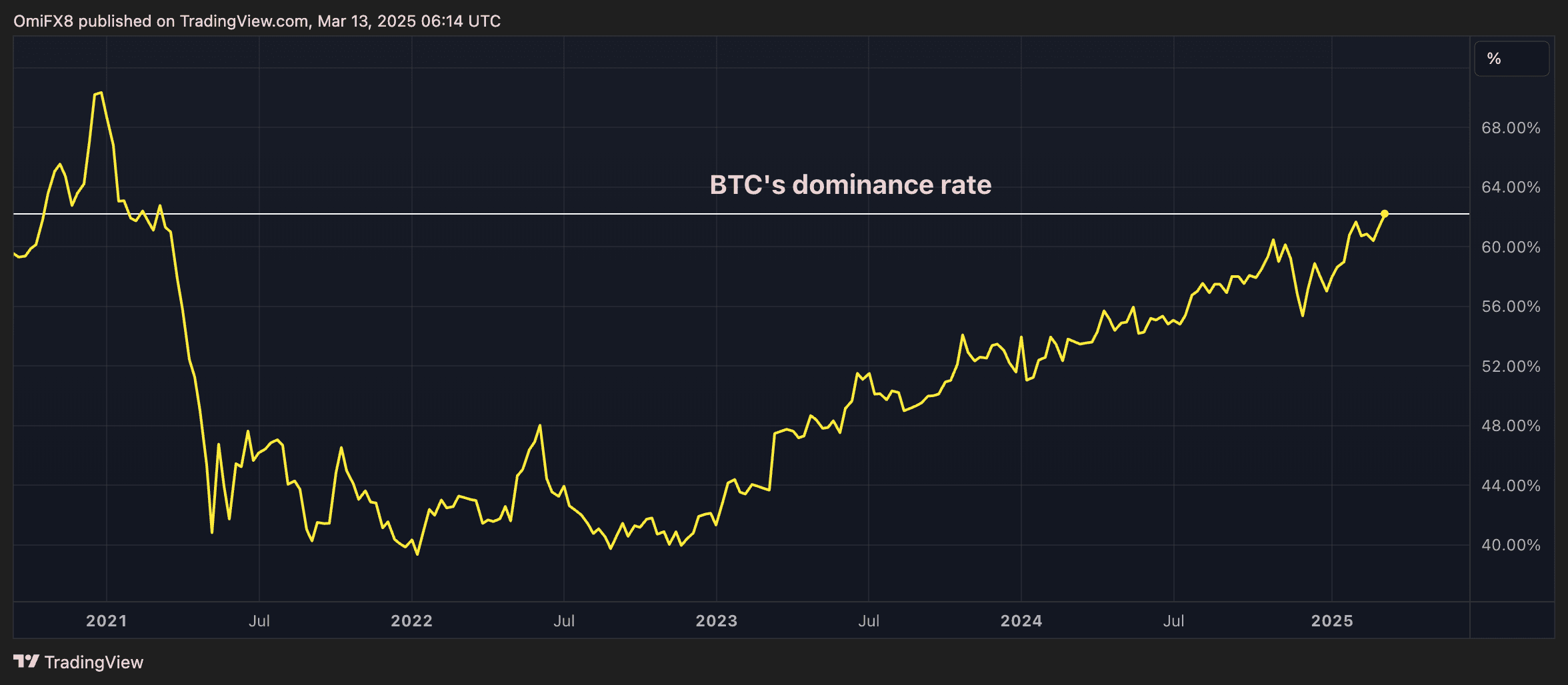

Bitcoin’s Dominance at a Four-Year High

In terms of market dominance, Bitcoin has reclaimed significant ground, with its dominance rate now sitting at 62.5%. This marks the highest level of dominance since March 2021, according to data from TradingView. This metric has surged from 55% to over 62% since the overall cryptocurrency market capitalization reached a high of over $3.6 trillion in December.

This increase in Bitcoin’s dominance signifies a persistent preference for BTC, particularly in times of broader market downturns, as investors seek stability amidst volatility.

BTC’s dominance rate. (TradingView/CoinDesk)